The all-in-one platform for managing multi-asset portfolios

MSCI RISKMETRICS

Make informed investment decisions with analytics covering more than 22 million unique securities

Used by investment managers to manage risk across asset classes, from holdings to enterprise level

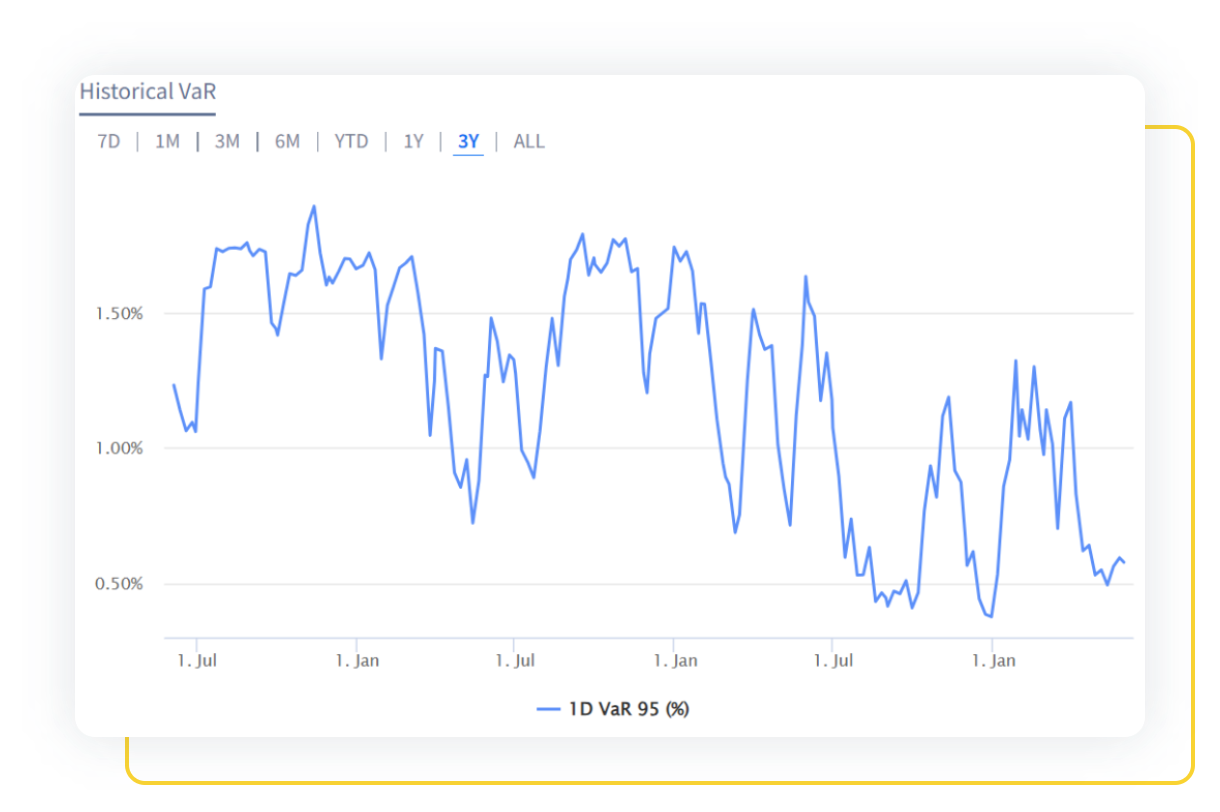

- Parametric, historical simulation and Monte-Carlo Value-at-Risk. Position and portfolio sensitivities.

- Historical and user-defined stress testing, shock any risk factor relevant to your portfolio

- Get an edge in decision making with pre-trade what-if simulations

MSCI BARRAONE

Identify and manage your underlying factor risk exposures

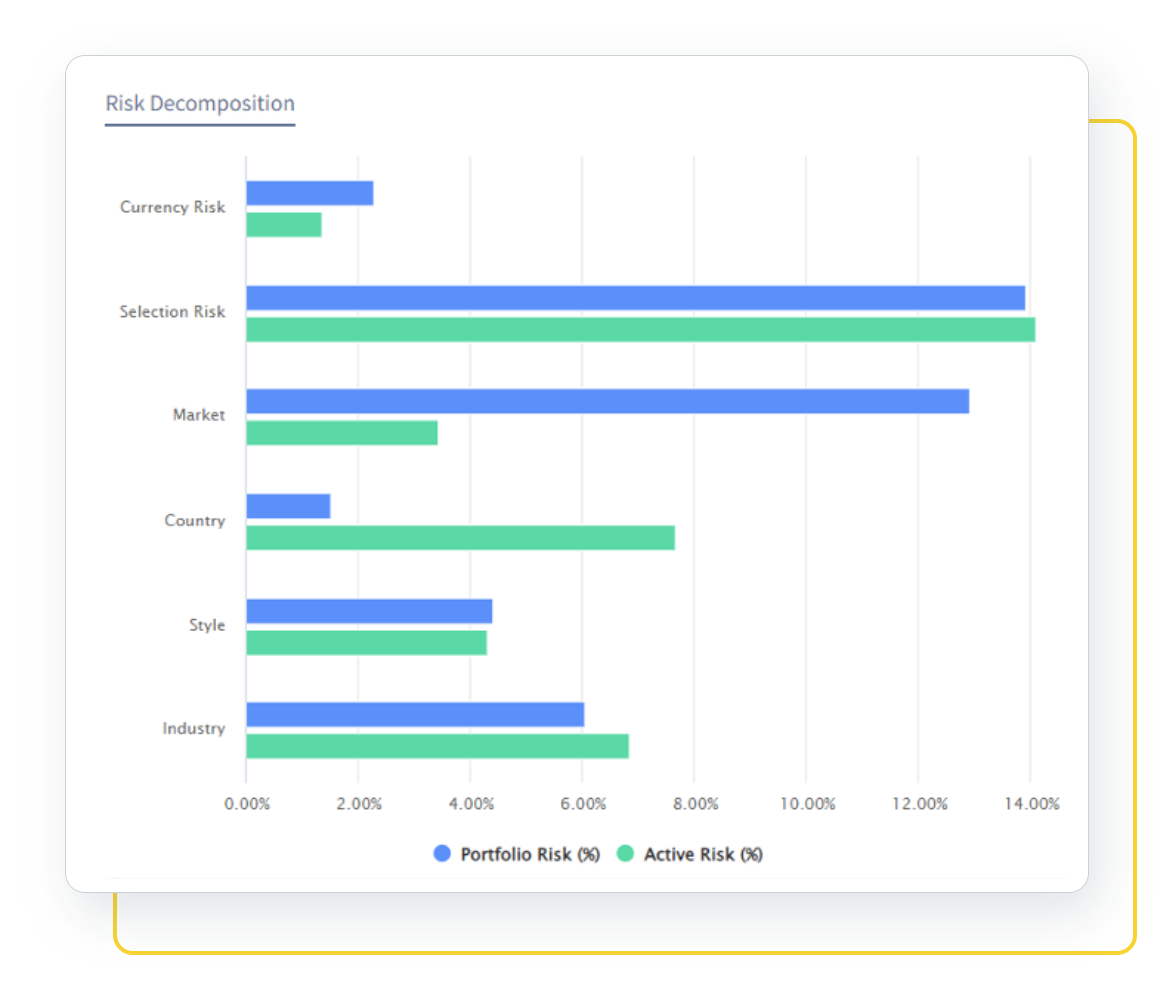

Identify and manage risk across multiple asset classes and global markets:

- Decompose risk into fundamental source of absolute and relative risk using common factors

- Forecast risk over long horizons (6 to 12 months)

- Stress test returns under historical and expected market dislocations

LIQUIDITY ANALYSIS

All the liquidity risk management metrics you need, in one place

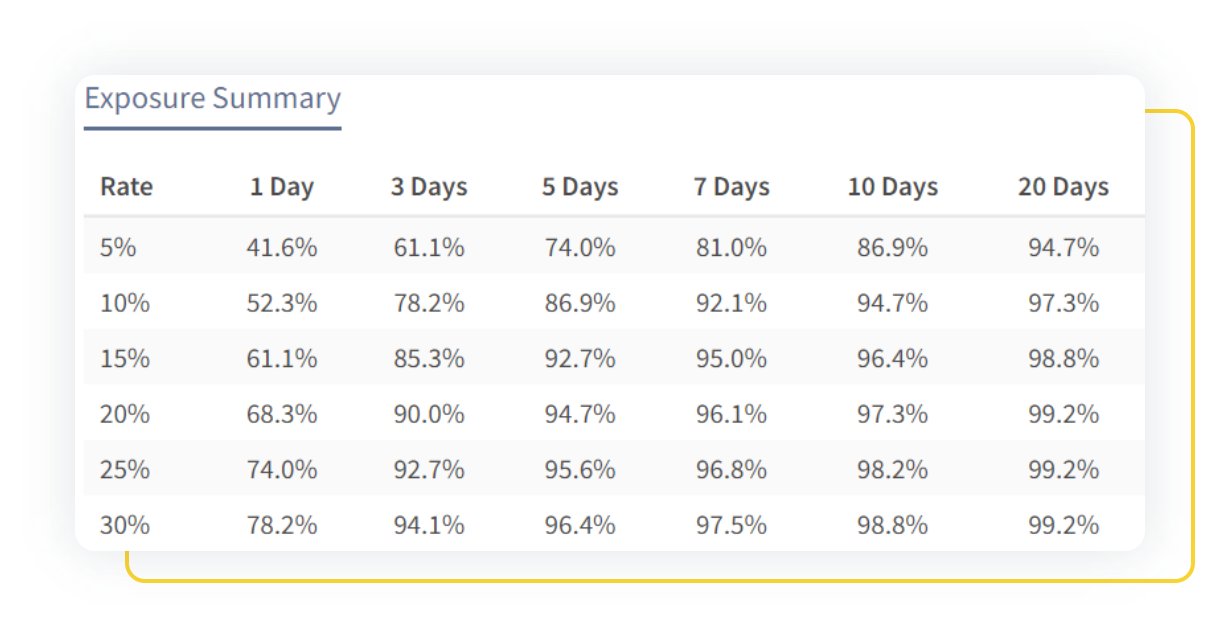

A complete tool for liquidity risk management:

- Maintain a complete and accurate view of portfolio liquidity

- Quickly identify liquidity bottlenecks in asset allocations

- Monitor the time it would take to liquidate individual holdings and complete portfolios

“Sesame has allowed our team to understand in-depth portfolios’ risk and performance by security, industry and numerous other factors. The analytical engine of the software is very robust, yet the product is easy to use.”

Kepler Liquid Strategies

More powerful features at your fingertips

Offices

London Office

52a Cromwell Road,

London, SW7 5BE,

United Kingdom

Paris Office

140 rue Victor Hugo,

92300 Levallois-Perret,

France

Pune Office

B -111, Pride Silicon Plaza, S. No. 106 A, Senapati Bapat Road, Pune - 411 016,

India

.svg)