The all-in-one platform for managing multi-asset portfolios

The command centre for managing multi-asset portfolios

By resolving data aggregation, analytical and reporting challenges to inform decision making, and allowing you to streamline operations with workflow tools, Sesame One allows you to achieve complete portfolio control.

Take a self-guided tour

Analyse

Analyse

Report

Report

Marketplace

Marketplace

Monitor

Monitor

Collaborate

Collaborate

Security

Security

All your data, securely stored in one place

Automatic data feeds with your banks and custodians and AI-powered tools for uploading private and alternative asset data, all within your own physically isolated database.

Institutional-grade analytics at your fingertips

Enhanced analytics that provide actionable insights into performance, risk and exposure to inform decisions for even the most complex portfolios.

Quickly create customised reports

The only tool you will ever need for building, scheduling and distributing automated investment reports to your team and stakeholders.

Curated private market opportunities

Access institutional-grade opportunities across private equity, pre-IPO shares, structured products, real assets, and more - all within a single platform.

Take swift action with portfolio alerts

Receive alerts alerts when they matter most so you and your team can get straight to investigating and taking corrective action.

Stay organised with workflow and task management tools

Streamline operational workflows when at your desk and on the go, with centralised document storage, task management and contact directories.

Enterprise-grade security for peace of mind

Keep your data secure at all times with an ISO 27001 certified, and SOC 2 compliant company - with your data stored on your own physically isolated database. Control access to information with granular role-based permissions.

See Sesame in action

Find out how Sesame gives you the actionable insights you need to fuel better investment outcomes

Take a self-guided tour

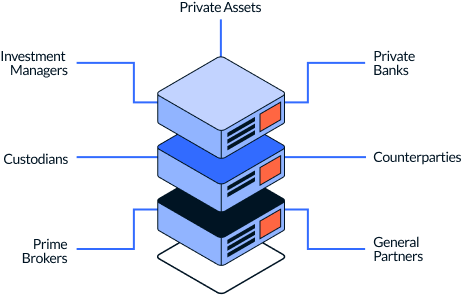

Sesame Architecture Overview

Combining the power of scalable data management with an intuitive front-end experience

ISO 27001 certified infrastructure

Testimonials

You'll be in great company

Hear what our amazing clients have to say about working with us.

.webp)

Landytech has provided the data foundation to transform how we work. It’s delivered efficiency through automation, freeing our team to focus on higher-value tasks, while enabling the development of enhanced investment reporting services that will strengthen client relationships and drive future revenue.

Affinity Trust Limited

We've cut reporting time from roughly 3 days to 3 hours per month. Having assessed two alternative providers, Sesame One prevailed because it demonstrated genuine reporting flexibility, strong analytics, a team willing to incorporate custom requirements rapidly, and clear momentum in product development.

French-based Family Office Advisor

At Ocorian, we are always seeking solutions that solve our clients’ complex problems. By partnering with Landytech and adopting Sesame, we set a new industry standard, offering our clients best-in-class consolidated wealth reporting. It ensures we can continue to deliver the exceptional service they expect from our expert team and facilitate their efficient, informed, and timely decision-making process.

Ocorian

Sesame has provided us with the consolidated data to substantiate discussions with clients around their wider wealth strategies, and the ability to anticipate challenges within portfolios and proactively mitigate them. Sesame has given us the tools to not only work smarter but to work more holistically too, with our clients reaping the benefit.

Accuro

Our adoption of Landytech’s Sesame is part of the Scouting Group's growth strategy. Having continuously evolving software sets us spart in the Family Office landscape and empowers us in our commitment to advancing investment management in Italy and Europe. This partnership allows us to provide clients with an international multidisciplinary team of experts with proven experience to analyse new trends and offer an innovative service.

Scouting SIM Family Advisors

Landytech's solution - Sesame - has allowed our team to understand in- depth portfolios' risk and performance by security and industry (and numerous other factors). The analytical engine of the software is very robust, yet the product is easy to use. Landytech's proactive efforts to manage risk, attention to detail, and responsiveness to new matters is unsurpassed.

Tycho Capital

Following an impressive demonstration of Landytech’s offering, we asked them to pitch alongside a reputable competitor. The decision to choose Landytech was unanimous. Their offering was far superior in terms of functionality, ease of use and presentation. During the course of our relationship, Landytech have delivered exactly what they promised and more. I cannot speak highly enough of both the platform and the team.

Guernsey-based Family Office

Each family’s got to look at that reporting system and feel that it is theirs. It needs to be the right colour, it needs to be branded, it needs to be white-labelled, it needs to look like it's come from our office. Landytech have mastered that well for us. For reporting to evolve, you need to work with a dynamic team growing their business with the same enthusiasm as yours so the two grow together. Landytech tick those boxes.

UK-based Multi Family Office

Landytech has developed a unique tool and solution for Family Offices. Sesame allows us to monitor a wide range of assets (traditional and alternatives), multi-currencies reports, a depth of data accessible in an organised manner.

Paris-based Multi Family Office

Landytech have proven to be open-minded, resourceful and trustworthy in all that they do. From the outset, they have been able to provide suggestions as to how we can best achieve our client reporting goals in a timely and accurate manner, offering innovative solutions to the challenges we face of bringing together data from disparate sources.

Skerryvore Asset Management

Sesame makes my life far easier. I can see everything in my portfolio in the detail I require and updated in real time – rather than a series of disparate and intermittent snapshots. Working with better information makes my investment management more effective and less stressful.

UK-based UHNWI

Shiprock Capital’s growth in the Global Distressed and Special Situations market has led us to partner with Landytech to strengthen our risk infrastructure and enhance our operational efficiency. Landytech's solution, Sesame, enables us to effectively mitigate risk at scale across our asset classes, access advanced analytics to make informed investment decisions, and streamline our reporting and data management workflows.

Shiprock Capital Management Limited

Offices

London Office

52a Cromwell Road,

London, SW7 5BE,

United Kingdom

Paris Office

140 rue Victor Hugo,

92300 Levallois-Perret,

France

Pune Office

B -111, Pride Silicon Plaza, S. No. 106 A, Senapati Bapat Road, Pune - 411 016,

India