The all-in-one platform for managing multi-asset portfolios

Family Office Software

The complete platform for managing multigenerational wealth

Landytech's Sesame One platform allows family offices with multi-asset portfolios to resolve critical data aggregation, analytical and reporting challenges to inform investment decision making and achieve operational efficiency.

Take a self-guided tour

Experience the power of Sesame for family offices, in your own time and at your own pace.

Make informed investment decisions

Access a complete view of your entire multi-asset portfolio in a live dashboard, with rich insights into performance, exposure, liquidity, risk and forecasts.

Enhance operational efficiency

Eliminate manual work with automated data sourcing and management. Centralise tasks, notes, and documents, for a single, secure view of operations.

Mitigate risk in your family office

Reduce the risk of manual error in data management and reporting. Stay on top of portfolio developments with notifications and a mobile app.

Simplify processes, maximise returns

A family office operating system that delivers clear ROI

Automate your most burdensome data management processes to drive efficiency and reduce costs. Access institutional-grade analytics and reporting to inform decisions that maximise investment outcomes.

Save more than 80% of the time currently spent on reporting

Reduce the hours spent every week on data consolidation to minutes

Respond to ad hoc reporting requests in minutes not days

Save more than 80% of the time currently spent on reporting

Respond to ad hoc reporting requests in minutes not days

The unified operating system for family offices

Manage multigenerational wealth with full clarity and control in a single platform

Take a self-guided tour

All the tools family offices need to manage multigenerational wealth

A single platform to manage public and private assets with confidence and precision

Data consolidation

Consolidate data from all of your banks and custodians, seamlessly integrated with data for any private and alternative assets.

- Over 500 custodian feeds globally

- Doc AI for alternative investment documents

-

Intuitive tools for non-custodied assets

- 10,000+ connections to banks through open banking

- Rigorous data validation protocols

- Your own physically isolated database for complete control and security

.png)

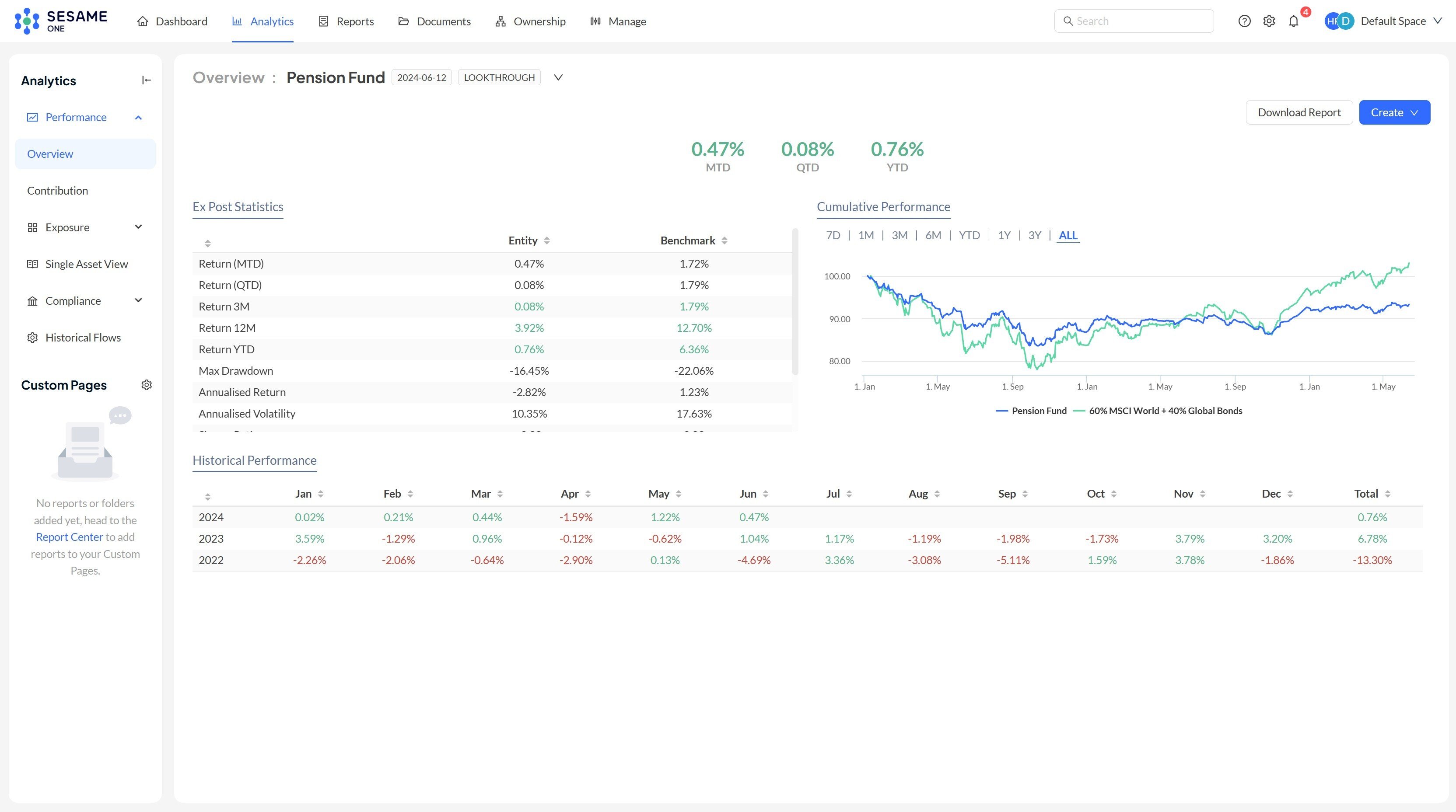

Institutional-grade portfolio analytics

Analyse your entire multi-asset portfolio with full drill-down flexibility and intuitive visualisations across performance, risk, liquidity and exposure metrics.

- Performance contribution, attribution, P&L and relative performance metrics

- Understand your exposures across all asset classes and investment vehicles

- Slice-and dice your portfolio from any dimension (sector, region, currency, etc.)

- Assess portfolio risk with stress testing, scenario analysis and factor decomposition, powered by MSCI

Private market analytics

Analyse performance across your entire private capital portfolio including private equity, venture capital and real estate.

- Review multiples (DPI, TVPI, RVPI) and internal rate of returns (IRR)

- Project future capital calls and distributions at individual fund and portfolio level

- Track fees and expenses across funds

- Assess the impact of future cashflow projections and exposure assumptions to reach and maintain your target allocation

.png)

Deliver tailored reporting to stakeholders

Provide continual and tailored communication on all aspects of the portfolio to your team and stakeholders. Build custom reports in minutes so you can respond quickly to any ad hoc requests.

- Professional PDF reports that automatically refresh

- Templated and customisable reports

- Dynamic and interactive analytical reports

- Drag-and-drop for easy customisation

- Automated scheduling and distribution

.png)

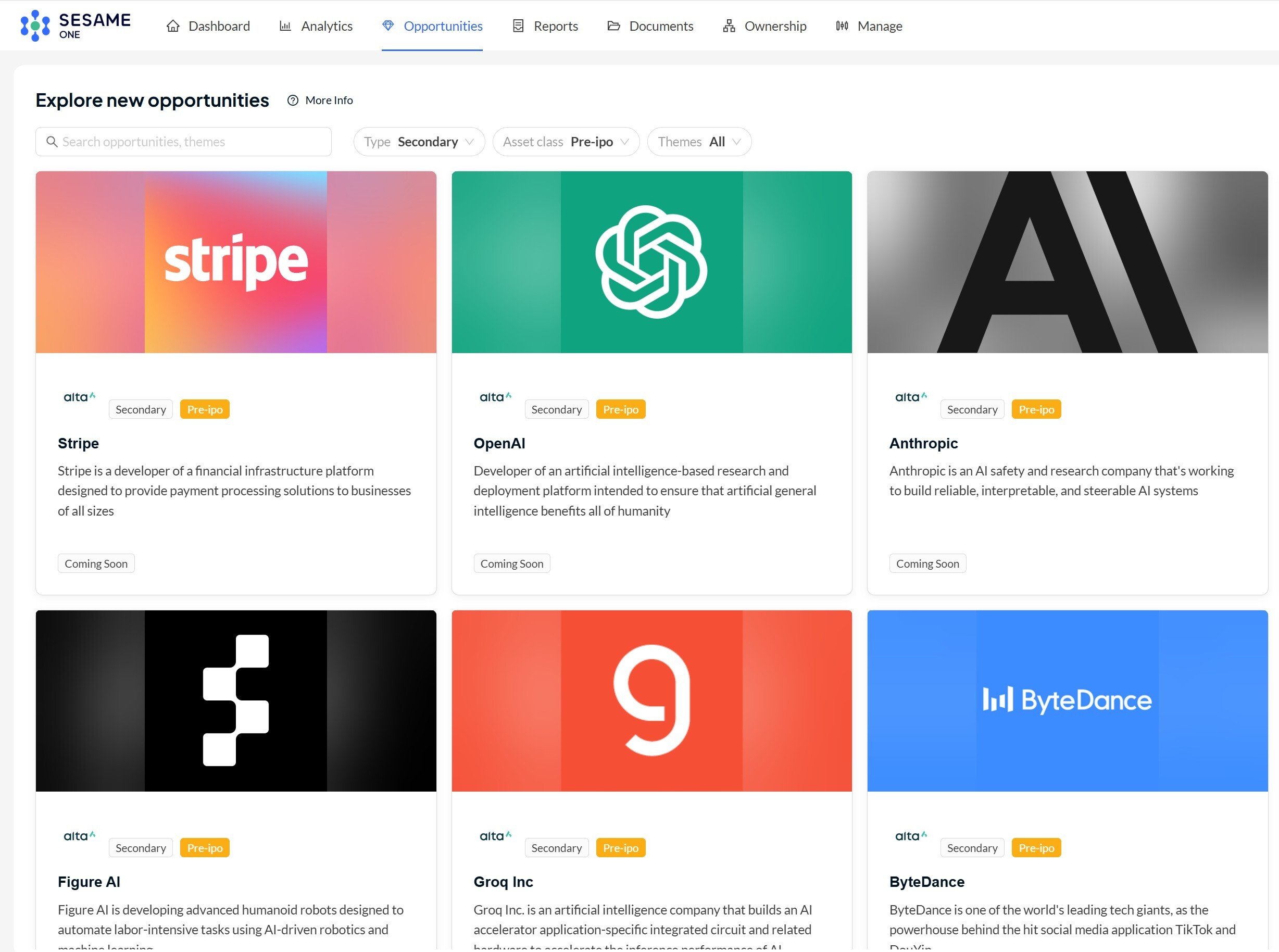

Marketplace

Curated opportunities across private equity, pre-IPO shares, structured products, real assets, and more - all within a single platform.

- A streamlined interface for accessing a variety of opportunities, without having to switch tools.

- Gain access to a curated list of private market opportunities across a range of providers.

- Explore a range of opportunities most investors never see, in an exclusive compilation.

Marketplace is provided through Landy Partners Ltd, a Landy Tech Ltd company, authorised and regulated by the FCA (FRN [709691]).

Manage ownership structures

Visualise your ownership structure across all legal entities including investment vehicles, SPVs, holding companies, operating companies, trusts and more.

- Seamlessly manage co-ownership and pro rata ownership structures

- Account for intercompany loans

- Granular user permissioning and rights of access

.png)

Collaborate

Power seamless collaboration across your family office. Sesame One unites tasks, notes, workflows, contacts, and mobile access into a single, connected platform.

- View important reports and dashboards from the mobile app

- Stay organised and collaborate more effectively with tasks and notes

- Keep all your documents organised, secure and easily accessible

- Tightly control access to data with role-based permissions

-1.png)

Testimonials

You'll be in great company

Hear what our amazing clients have to say about working with us.

We've cut reporting time from roughly 3 days to 3 hours per month. Having assessed two alternative providers, Sesame One prevailed because it demonstrated genuine reporting flexibility, strong analytics, a team willing to incorporate custom requirements rapidly, and clear momentum in product development.

French-based Family Office Advisor

Our adoption of Landytech’s Sesame is part of the Scouting Group's growth strategy. Having continuously evolving software sets us spart in the Family Office landscape and empowers us in our commitment to advancing investment management in Italy and Europe. This partnership allows us to provide clients with an international multidisciplinary team of experts with proven experience to analyse new trends and offer an innovative service.

Scouting SIM Family Advisors

At Ocorian, we are always seeking solutions that solve our clients’ complex problems. By partnering with Landytech and adopting Sesame, we set a new industry standard, offering our clients best-in-class consolidated wealth reporting. It ensures we can continue to deliver the exceptional service they expect from our expert team and facilitate their efficient, informed, and timely decision-making process.

Ocorian

Sesame has provided us with the consolidated data to substantiate discussions with clients around their wider wealth strategies, and the ability to anticipate challenges within portfolios and proactively mitigate them. Sesame has given us the tools to not only work smarter but to work more holistically too, with our clients reaping the benefit.

Accuro

Following an impressive demonstration of Landytech’s offering, we asked them to pitch alongside a reputable competitor. The decision to choose Landytech was unanimous. Their offering was far superior in terms of functionality, ease of use and presentation. During the course of our relationship, Landytech have delivered exactly what they promised and more. I cannot speak highly enough of both the platform and the team.

Guernsey-based Family Office

Each family’s got to look at that reporting system and feel that it is theirs. It needs to be the right colour, it needs to be branded, it needs to be white-labelled, it needs to look like it's come from our office. Landytech have mastered that well for us. For reporting to evolve, you need to work with a dynamic team growing their business with the same enthusiasm as yours so the two grow together. Landytech tick those boxes.

UK-based Multi Family Office

Landytech has developed a unique tool and solution for Family Offices. Sesame allows us to monitor a wide range of assets (traditional and alternatives), multi-currencies reports, a depth of data accessible in an organised manner.

Paris-based Multi Family Office

Sesame makes my life far easier. I can see everything in my portfolio in the detail I require and updated in real time – rather than a series of disparate and intermittent snapshots. Working with better information makes my investment management more effective and less stressful.

UK-based UHNWI

Secure and compliant

Landytech’s products are backed by the most highly prestigious certifications and represent an industry-leading standard, so family offices can feel confident all of their data remains secure

.png)

Resources for family offices

Learn more about family office technology with interactive demos, brochures and sample reports

Self-guided Tour

Explore Sesame for Family Offices

Take a self-guided tour

Experience the power of Sesame for family offices, in your own time and at your own pace.

Brochure

Sesame for Family Offices

Sample Report

Consolidated Family Office Report

.png?width=1416&height=871&name=Untitled%20design%20(42).png)

Download sample report

Sample consolidated investment report for the multi-asset portfolio of a family office

Your command centre for managing multigenerational wealth

Join the family offices across the globe that are already using Sesame to manage multi-asset portfolios with confidence and precision.

Brochure

Sesame for Family Offices

.png?width=419&height=235&name=Rectangle%206%20(1).png)

Self-guided Tour

Explore Sesame for Family Offices

Take a self-guided tour

Experience the power of Sesame for family offices, in your own time and at your own pace.

.png?width=419&height=234&name=Rectangle%205%20(1).png)

Buyers Guide

Choosing the Right Family Office Software

Offices

London Office

52a Cromwell Road,

London, SW7 5BE,

United Kingdom

Paris Office

140 rue Victor Hugo,

92300 Levallois-Perret,

France

Pune Office

B -111, Pride Silicon Plaza, S. No. 106 A, Senapati Bapat Road, Pune - 411 016,

India