The all-in-one platform for managing multi-asset portfolios

PERFORMANCE ANALYTICS

Receive instant insights on your levels and sources of performance

Understand the drivers and detractors of performance with more clarity than ever before.

- Performance contribution by any grouping including sector, region, asset class and more

- Brinson performance attribution to understand allocation and security-selection effects

- All the ex-post statistics you need to monitor performance over multiple time intervals

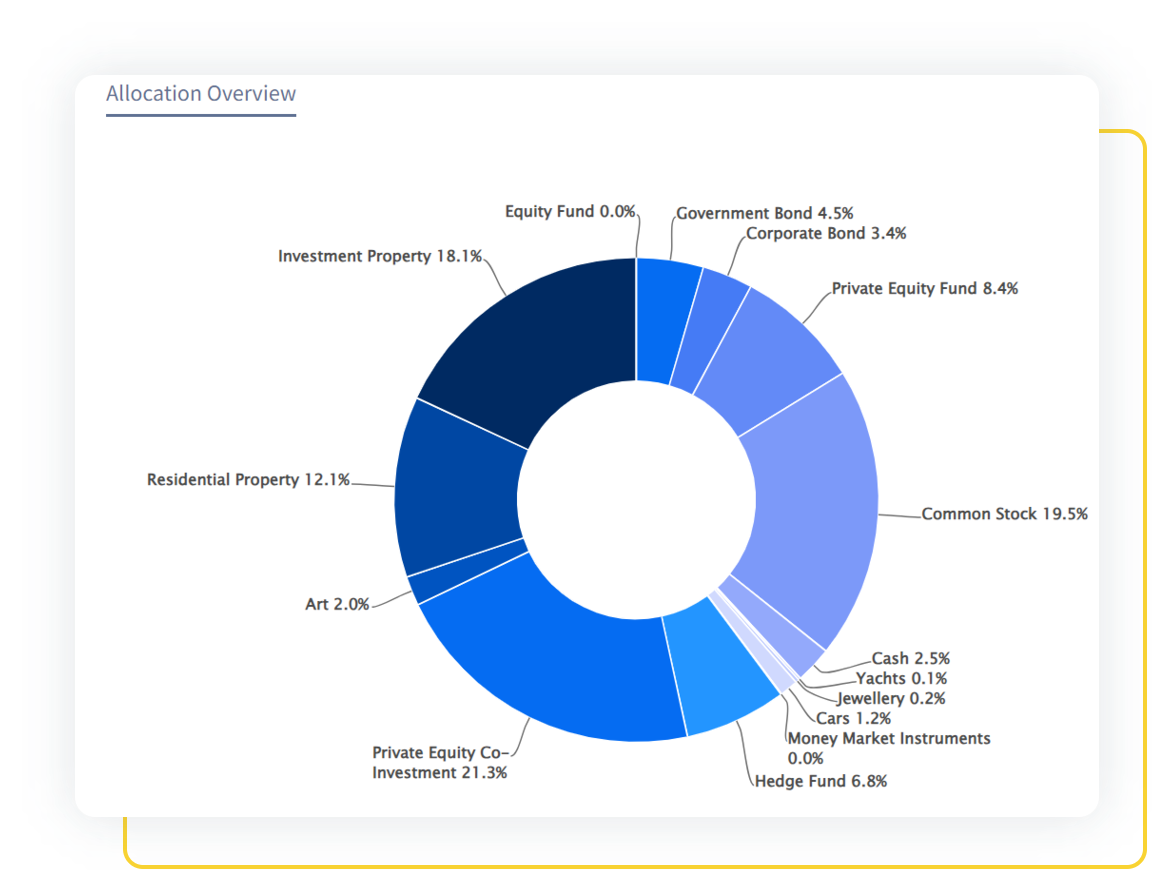

EXPOSURE

A complete picture of exposures for informed allocation decisions

Instantly identify and monitor portfolio exposure to market sectors, geographic regions, currencies and more.

- Monitor changes in portfolio exposure and concentration in near real-time

- Keep track of historical exposure and visualise changes over time

- Includes delta-adjusted and duration-adjusted exposure

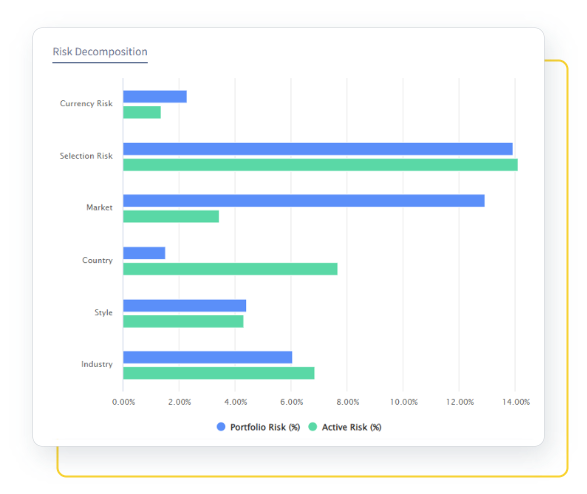

RISK MANAGEMENT

Risk analytics powered by MSCI BarraOne and RiskMetrics

Combine institutional-grade analytics and highly configurable reporting to understand your portfolio risk in more depth than never before.

- Identify and manage your underlying factor risk exposures

- Parametric, historical simulation and Monte-Carlo Value-at-Risk. Position and portfolio sensitivities.

- Historical and user-defined stress testing, shock any risk factor relevant to your portfolio

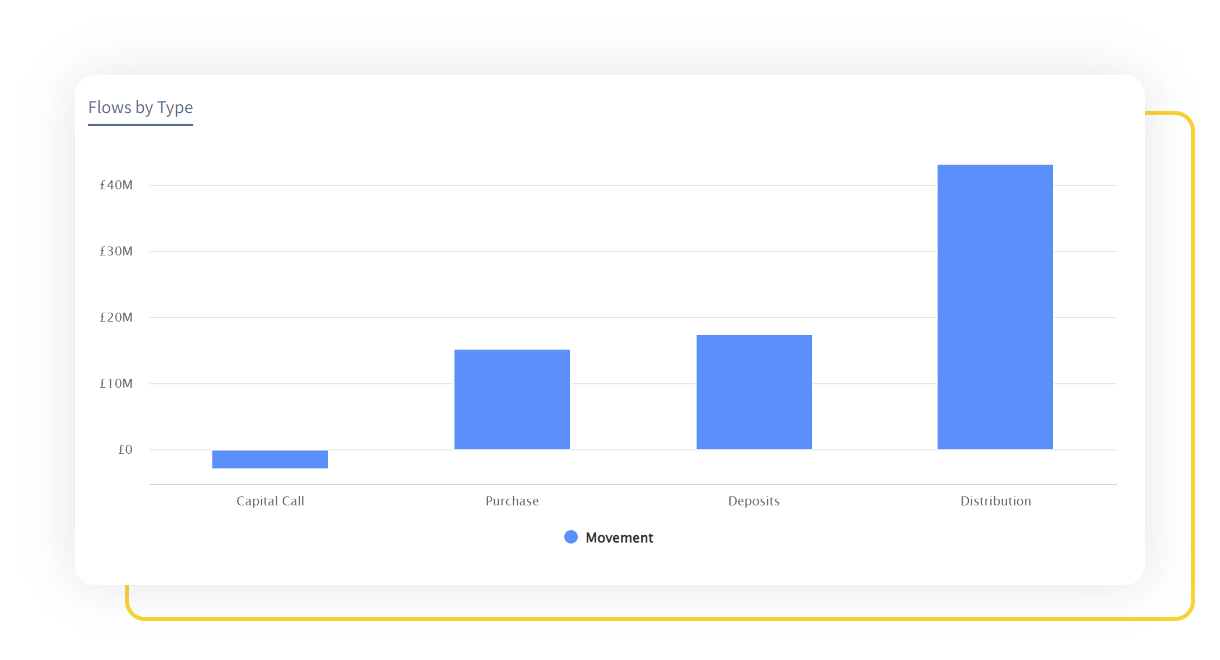

TRANSACTIONS

Keep a close eye on your cash flows and fees

Bring all your transaction data tools under one roof:

- Take command of your cash flow projections and liquidity needs with a full view of your income and expenditure

- Gain complete breakdowns of the fees you are being charged including management, custodian and brokerage fees

“Sesame has allowed our team to understand in-depth portfolios’ risk and performance by security, industry and numerous other factors. The analytical engine of the software is very robust, yet the product is easy to use.”

Kepler Liquid Strategies

More powerful features at your fingertips

Resources

Insights to help you build institutional-grade analytics capabilities

BLOG

Managing Underlying Risk Drivers with Multi-Asset Factor Models

In this blog, we demystify multi-asset factor models so asset owners can gain a deeper understanding of how portfolio risk can be decomposed to identify hidden risk hotspots.

WEBINAR

Factors for Family Offices: Seeing Portfolio Risk Through a New Lens

MSCI's Sam Rubandhas and Landytech’s Gregory Chouette and Ramis Kumar demystify risk factors and how they affect multi-asset class portfolios, so family offices can get a deeper lens into what's driving their portfolio risk.

BLOG

Portfolio analytics: Why cloud solutions are the future

The need to manage large volumes of data and perform complex calculations at speed have left many firms’ legacy systems and outdated technology struggling to keep up. It’s time to take to the cloud.

Offices

London Office

52a Cromwell Road,

London, SW7 5BE,

United Kingdom

Paris Office

140 rue Victor Hugo,

92300 Levallois-Perret,

France

Pune Office

B -111, Pride Silicon Plaza, S. No. 106 A, Senapati Bapat Road, Pune - 411 016,

India