Written by Landytech

11 Feb 2025In recent years, the complexity of performance measurement and risk calculations and the volume of data required to fuel them has increased exponentially, presenting asset managers with a significant challenge.

These pressures mean today’s reporting systems must be scalable and efficient. The need to manage large volumes of data and perform complex calculations at speed have left many firms’ legacy systems and outdated technology struggling to keep up.

That’s why asset managers are increasingly turning towards secure decentralised systems and the scalable, efficient computational power they offer. It’s time to take to the cloud.

Why legacy systems are no longer enough

Keeping up with complex strategies

Manually tracking performance and risk is burdensome at the best of times. In the pursuit of higher returns, keeping up with ever more complex investment strategies means consolidating and analysing vast datasets to provide meaningful performance and risk insights. In addition to the volume of data, investment teams are now handling performance calculations for multiple clients, in different operating regions, each with their own measurement requirements.

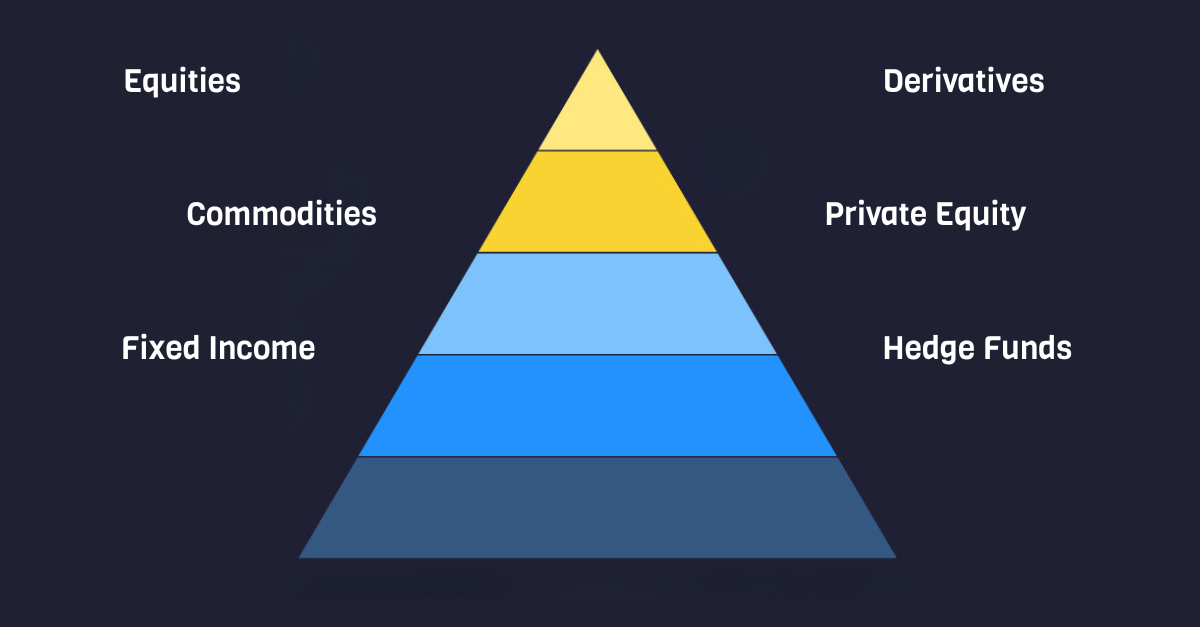

The complexity only increases when you consider evolving investment vehicles, fund types and asset classes. Not to mention alternatives and other non-marketable investments, such as derivatives, private equity and structured products. Once you factor in the need to sync up varied methodologies to meet the unique requirements of each asset class, the sheer difficulty of getting the data sourcing and performance calculation process right – and the ease of getting it wrong – becomes clear.

This complexity becomes even more of a challenge when tackling risk requirements for complex instruments. In legacy systems, when conducting stress tests and scenario analysis, you’re forced to specify your own realistic factor shocks, with an appropriate modelling framework and input parameters. There are many pitfalls to avoid here. Cloud-based systems, in contrast, provide off-the-shelf scenarios, backed by empirical research and with a robust and dynamic system in place, to adapt modelling choices based on each individual instrument’s characteristics.

Firms need the right data management and performance reporting tools to overcome this complexity. A system to aggregate, validate data and support a wide range of calculation methodologies, and produce institutional-grade reports. Investment managers without comprehensive access to that capability put themselves at a strategic disadvantage.

Keeping the regulators happy

We all know that regulators can be demanding. A new wave of global regulation has led to an explosion of reference data that needs to be sourced, aggregated, and reported on, meaning demands for robust processes and high-quality reporting have never been higher.

Transparency into data and calculations has also become critical for a wide range of analytics processes including portfolio sensitivities, scenarios, stress testing, performance and risk contributions and liquidity. All collated under strict time pressures. With no choice but to provide this information both timely and accurately, manual processes just can’t keep up.

One way to keep abreast of regulatory changes and managing the multiple data sources is to utilise a cloud-based performance reporting solution that is data agnostic. Cloud-based platforms can seamlessly integrate with a vast number of data sources and analytics engines to serve as a single source of information for calculations, analysis and reporting.

Investor demands are increasing

Allocators have become incredibly savvy when it comes to performance and risk analytics. There has been increased interest in analysing returns and this can present additional reporting challenges for asset managers. Allocators want to see results in specific formats, through various lenses, and in greater volumes. Faced with such unprecedented demand for volume and granularity, many legacy systems are beginning to strain.

Cloud-based software gives asset managers almost unlimited ability to scale up (or down) their analytical and reporting capabilities. Firms can innovate using automation solutions not available in their own legacy systems. They gain the operating flexibility to perform increasingly complex performance calculations and integrate quickly with risk analytics engines, without having to make significant investment commitments.

Empowering internal stakeholders

As asset managers strive for accountability and greater visibility across the investment process, internal stakeholders expect a complete view that includes the basics, integrated performance results and risk exposure analysis covering all asset classes.

Firms also increasingly require performance attribution through multiple methodologies to meet internal and external reporting requirements. With limited resources and a need for timely reports to support decision-making, asset managers are increasingly looking at data-driven approaches, backed by technology, to provide the comprehensive performance and risk analytics needed.

But the right calculations are only part of the solution, the delivery of this information is critical to support investment decisions. In recent years it has become crucial that performance reports and data are accessible across the whole investment team, ensuring that firms are operating from a single source of truth.

Adopting a cloud solution that can source data, provide the analytics, and build reports to meet requirements, ensures maximum visibility throughout the investment process.

Heading for the cloud

Many asset managers have taken their existing legacy systems as far as they can go. As requirements for performance and risk analytics continue to evolve, the gaps between what a legacy system can handle and what investment teams need to deliver grows too.

An absence of sophisticated performance and risk analytics in an increasingly competitive industry is leaving firms under pressure on multiple fronts.

Whether firms develop new systems in-house, or leverage commercially available solutions from top vendors, the objective is digital transformation. The time has come for firms to start moving away from their legacy systems and toward flexible, scalable and automated cloud-based systems. It’s the most effective way for firms to position themselves for long-term success and growth.

Find out more about how asset managers are leveraging cloud solutions to improve their risk management capabilities in our whitepaper The True Cost of Risk for Asset Managers.

Related Content

.png)

How Landytech is Revolutionising Client Reporting in the Investment Management Industry

Following Landytech's recent win in the Client Reporting category at the WealthBriefing Channel Island Awards, our COO, Gregory Chouette, had the pleasure of sitting down with Clear Path Media, the organisers of the awards, for an interview. In the...

Managing Underlying Risk Drivers with Multi-Asset Factor Models

For asset owners, understanding the level of risk in their portfolios is critical to both capital preservation and maximising returns.

While multi-asset class portfolios may appear diversified along set allocation targets, asset owners may be...

Best Practices in Investment Risk Management: 2024

As market volatility returns with a vengeance, an institutional-grade risk function is now a critical factor in investors’ allocation decisions.

For risk management, the ability to demonstrate extensive expertise alongside a deep understanding of...