Written by Landytech

19 Mar 2025

Data-driven digital solutions have become table stakes for trustees. They are no longer a far-off, future project to which firms should aspire. Clients’ digital service expectations are evolving now, and trustees need to deliver.

However, the way many trustees currently manage their data today is hindering their attempts at a full digital transformation. As the data environment gets more complex by the day, manual processes are no longer up to the task.

The ultimate objective is the complete automation of repetitive trust administration processes. But that takes expertise and a sophisticated technology backbone that is inextricably linked to data management. It leaves trustees with a choice. Undertake the investment and implement the capabilities in-house, or partner with a specialist third party. Either way, it’s a decision that can’t be delayed.

As trustees start their journey to a data-driven future, there are multiple complex data challenges they must overcome. Here’s how firms can go about solving them.

Sourcing data from custodians and banks

Data sourcing poses the fundamental challenge in any trust administration process. Data sources for the complex, multi-asset class portfolios fiduciaries typically manage are fragmented and comprise disparate, non-standardised datasets, including private and alternative assets.

To consolidated data across these asset classes, fiduciaries need to know:

- What assets and liabilities the client has

- The valuation of those assets and liabilities at a given point in time

- What transactions have occurred over a given time period

Providing the timely and granular reporting clients now expect means setting up an automated data sourcing process, using data feeds established with the client’s custodians and banks. Information can then be relayed via SFTPs, APIs, EBICS, etc. (SFTP is the most common, but different jurisdictions favour different protocols). That means saying goodbye to the manual aggregation of multiple CSV and PDF files!

Automated data sourcing requires no manual intervention, is comprehensive, delivers data in a consistent format over time and alleviates many of the security concerns around email data transfer.

Automation also allows for daily data sourcing, enabling fiduciaries to produce ad hoc reports when needed, and have completely refreshed data for monthly and quarterly reporting cycles. A daily refresh of data is almost impossible to sustain in a manual environment.

Automation does require IT capability to set up and maintain the feeds. However, this resource investment is comparatively small when considering capacity freed up – especially when outsourced to a third party.

Systems love standardised data

Once you are able to source data automatically, it will still have:

- Multiple file formats, such as text, CSV, Excel, PDF and XML.

- Variations in the content – such as the data within it, the delivery syntax and the identifiers used to recognise certain positions.

This information needs to be transformed into a single standardised schema that can be processed systematically for downstream reporting. And once the data is harmonised, it must be stored in a database.

Positions, assets, liabilities and transactions all need to refer back to a single object. Without that relationship, any downstream calculations around concentration, performance, and profit & loss will be impaired.

The data pipeline architecture will determine how information flows from the files into the database and what columns in each file need to be mapped to which database field.

Data validations must be embedded throughout the process to avoid importing incorrect data by accident and polluting the database.

Feeding data into your systems

Trustees need a complete data and reporting solution. That requires a strong technology infrastructure able to process vast amounts of data.

A platform built on open architecture connectivity principles can facilitate data consolidation and aggregation by allowing easy integration of data feeds to ensure data can be taken from relevant third-party sources.

Sophisticated APIs enable ready integration with existing internal systems.

Automation is here to stay

Sourcing, transforming, storing and enriching data across investments and multiple complex asset classes requires sophisticated IT engineering and financial data expertise, there’s no two ways about it.

If opting to build in-house, smaller trustees may struggle to find the budget to invest their limited capital in the necessary infrastructure. Even for bigger players, the cost, complexity and hassle of sustaining the requisite data processes pose a huge, ongoing burden. And by directing resources to the mechanics of data management, and away from higher value work, operational efficiency and client relationships may suffer.

Trustees have a choice. They can opt to hire an internal team of IT engineers and financial quants to develop and manage the necessary infrastructure. Or they can use a software solution with managed service expertise to handle the end-to-end data management processes for them.

What they can no longer do is ignore the growing pressure to provide a better client experience, enhance staff satisfaction and differentiate themselves in a fiercely competitive market.

For more information about how near-real-time access to quality data can help trustees prepare for the next generation, read our latest whitepaper.

Related Content

%20(1).png)

Unlock bookkeeping efficiency with Sesame Data - and offset implementation costs with the Jersey Better Business Grant

For trust companies, efficiency and accuracy in bookkeeping are paramount. Yet, many trust companies in Jersey still rely on manual processes that consume valuable time and resources. Enter Sesame Data, an innovative solution designed to automate...

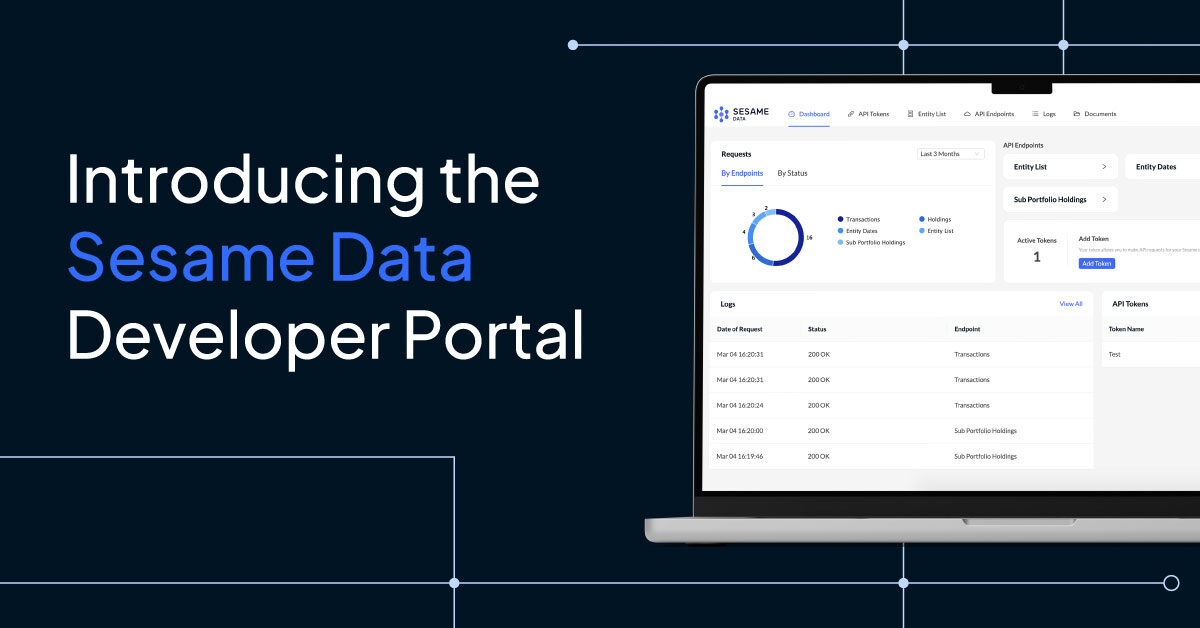

Ensure Faster API Integration With The Sesame Data Developer Portal

Discover the power of seamless custodied investment data integration with the launch ofthe Sesame DataDeveloper Portal. The portalis designed to empower developers with theAPI tools, documentation and resources necessaryto streamline...

Top 5 Family Office Data Challenges in 2023

In recent years, a key driver of family office investment in technology has been the need to have immediate access to near real-time performance data, to uncover operational efficiencies and provide consolidated reporting to families.

Whilst legacy...