Written by Landytech

19 Mar 2025

In recent years, the use of managed investments in trusts has grown significantly. This has put the onus on trustees to regularly review these investments and scrutinise their corresponding fund managers, alongside the management of private assets such as property, yachts, and collectibles.

Although investment management will usually remain outsourced, clients will expect trustees to know and provide ad hoc reporting on the asset classes and geographic regions to which the trust is exposed, as well as the liquidity of the assets. Liquidity is particularly important if the trust makes capital distributions or pays out an income.

All this is creating vast data requirements, under which legacy systems are starting to strain. However, more advanced software is now enabling trustees to reduce reliance on burdensome spreadsheets and all but eliminate manual processes when it comes to data management and reporting. Dedicated trust platforms can automatically source and process vast amounts of data and present it in customisable, visually compelling dashboards for faster and more effective portfolio monitoring.

But what are the underlying data challenges fuelling this technological shift?

1. Putting bookkeeping on autopilot

Effective bookkeeping requires effective data. For most trustees however, bookkeeping is a

time-consuming, manual process, prone to errors. For institutions required to send contract notes

or paper statements, employees often have to read them and key them in. It’s timely. It’s expensive. And it’s not engaging work to be doing that day in, day out, exacerbating key person risk of that employee leaving the business and siloed knowledge being lost. A much more attractive proposition for staff is to leverage their expertise to add value and oversight, making sense of the accounts and

making sure things are correct.

To make bookkeeping easier, it is important for trustees to understand the data that they need

and the format that they need it in, so that it can be consolidated and standardised. It is at that point that data can be fed automatically into their accounting system.

2. Stepping up portfolio monitoring

A key driver of trustees getting to grips with data management is the need to have ready access to up-to-date portfolio performance data for effective investment monitoring. Most trustees review investment performance quarterly, but with volatile markets and an uncertain economic outlook clients will be asking for ad hoc updates, meaning trustees need to have up-to-date information at all times. They can no longer afford to wait up to 8 weeks after quarter end for static reports from consultants.

Once trustees have drafted investment policy statements (IPS), assessed client tolerance to risk and created target asset allocations, it also falls to them to monitor the data needed to stay within any agreed limits and investment scope.

If trustees receive portfolio data that is refreshed daily, this can feed an alerts system that ensures they are able to quickly identify and rectify any breached IPS limits with investment managers. Such an agile view enables trustees to demonstrate outstanding fiduciary duty.

3. Consolidating public and private asset data

Ultra-high-net-worth (UHNW) clients these days have incredibly diverse portfolios. Allocations to real estate and private equity have surged in popularity in recent years. And other alternative investments including passion assets such as art, vehicles and wine are growing. As performance and valuation data for almost all private assets is sourced from multiple systems, spreadsheets and statements, bringing this data together for trust reporting and the provision of family office services is made even more difficult and time consuming.

Currently, most trustees have to source this data manually and consolidate it in spreadsheets. Having communicated with multiple relationship managers and logged into multiple banking portals to get all the necessary data, it is often no longer completely up to date by the time it is used for reporting. Partnering with a provider that can automate all of these data pipelines alleviates much of the burden for trustees.

4. Enhancing investment risk management

In line with more timely monitoring of investments, trustees are beginning to take a much more proactive approach to risk management. However, the data that they receive from fund managers often does not provide them with an adequate understanding of a client’s aggregate exposure to risk. And with specialised risk personnel and sophisticated risk systems coming at a premium, trustees often lack the resources and operational capacity to perform comprehensive risk analysis and monitor risk across all asset classes.

Recognising the importance of data and robust risk analysis to developing risk capabilities, trustees are increasingly turning to software that enables them to monitor investment risk and exposures, in addition to measuring potential liquidity risk that could emerge under various economic scenarios.

5. Keeping client data safe

UHNW clients place a significant premium on their personal privacy, meaning trustees have a responsibility to not only protect their clients’ assets, but also to keep their confidential information safe. And given the vast amount of wealth trustees look after, they are an increasingly popular target for cyber-attacks.

To counteract the rising threat and ensure data is best protected from cyber-attack, trustees are entrusting their data to the cloud, instead of the server-based systems and hard copies of old. Cloud-based software solutions employ security measures beyond the affordability of most businesses. Sophisticated detection systems, strong authentication, and encryption techniques to protect user data are standard.

Unlocking The Power of Your Data

With up-to-date and consolidated data, trustees can make swift, informed investment decisions and significantly upgrade their risk management capabilities. They can also improve their investment monitoring processes, to facilitate more comprehensive periodic performance reviews. With the right trust reporting software, trustees can all but eliminate repetitive data management tasks, reclaiming time for value-add activities, such as relationship building and business development.

Related Content

%20(1).png)

Unlock bookkeeping efficiency with Sesame Data - and offset implementation costs with the Jersey Better Business Grant

For trust companies, efficiency and accuracy in bookkeeping are paramount. Yet, many trust companies in Jersey still rely on manual processes that consume valuable time and resources. Enter Sesame Data, an innovative solution designed to automate...

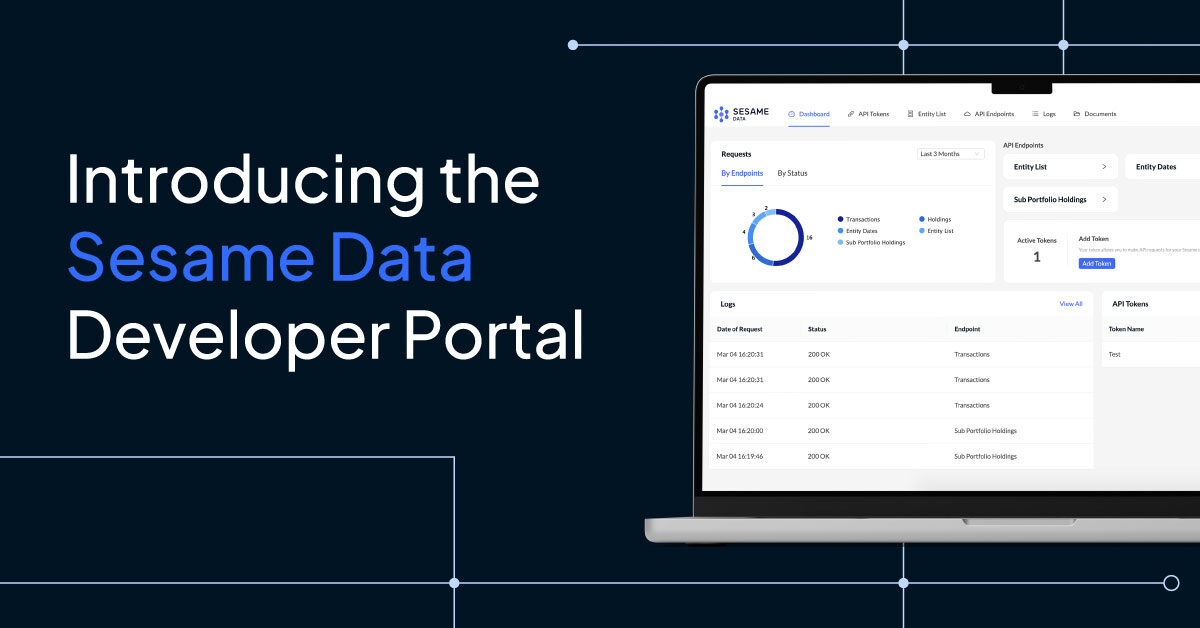

Ensure Faster API Integration With The Sesame Data Developer Portal

Discover the power of seamless custodied investment data integration with the launch ofthe Sesame DataDeveloper Portal. The portalis designed to empower developers with theAPI tools, documentation and resources necessaryto streamline...

Top 5 Family Office Data Challenges in 2023

In recent years, a key driver of family office investment in technology has been the need to have immediate access to near real-time performance data, to uncover operational efficiencies and provide consolidated reporting to families.

Whilst legacy...