/Logos/Landytech_LogoONLY_BleuSMALLER-1.png)

Written by Ben Goble

23 Jan 2023Interest in ESG has increased exponentially in recent years and there has been no sign of slowing in 2022, so far. But it is not just inflows to ESG funds that has been increasing. As policymakers turn their attention to environmental, social, and governance concerns, there has been increased pressure for asset managers to provide more data and consistent reporting around ESG investments.

Although a tightening of regulation is presenting asset managers with new data and reporting challenges that must be addressed, it is also creating new market opportunities. In particular, the opportunity to develop new fund vehicles that legitimately address environmental, social and governance concerns, and meet the demands of today’s ESG-conscious investors.

So, what are the trends shaping the ESG agenda for asset managers?

1. Increased regulatory burden

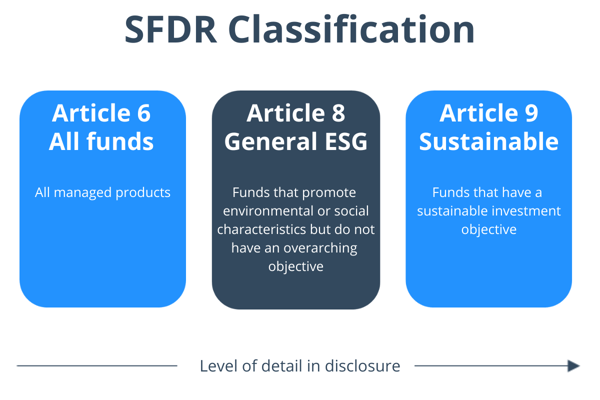

2021 saw the staggered rollout of the Sustainable Finance Disclosure Regulation (SFDR) by the European Commission, which aims to integrate sustainability into the core of the investment process and stamp out greenwashing. There have been some delays in the implementation of SFDR requirements, but asset managers are already having to comply with adverse impact disclosures in 2022.

SFDR requires that UCITS and AIFMs must designate investment products as an Article 6, 8 or 9 fund, and make certain disclosures in-keeping with this choice. SFDR is already having an impact on financial market participants and issuers, as ESG transparency and standardisation of reporting becomes the norm.

SFDR Articles 6, 8, and 9 Summary

Alongside the ongoing rollout of SFDR regulation, green taxonomy and MiFID sustainability preferences are being added to the mix. Green taxonomy in the EU sets out the requirements which economic activities must meet in order to be considered environmentally sustainable. Outside the SFDR jurisdiction, the UK has been looking to define their take on ‘avoiding harm’ and ‘doing good’ in terms of economic activity and corporate conduct. In the UK, reporting against the UK taxonomy will also need to be included in SFDR disclosures.

As of 2nd August, asset managers will have to ask investors to specify their sustainability preferences. The MiFID questionnaire will need to be used to determine investment preferences and identify suitable products based on the results. The aim is to align product choices with investors’ environmental, social and governance concerns, and ensure products are also aligned with the European taxonomy.

And although a lot of attention has been placed on environmental concerns, work on social taxonomy and the increased focus on human rights have also continued.

To comply with these new regulations, ESG data and ratings are increasingly being emphasised as the basis for firms to evidence ESG credentials, which is why data and reporting quality, reliability and standardisation are firmly under the microscope in 2022.

2. Spotting the green washers

As interest in ESG investing continues to grow, investor demands for sustainable investment strategies and financial products continues to increase. However, that has also led to an increase in the number of funds aiming to take advantage of this trend via ‘greenwashing’. This is where investment products are marketed as more sustainable than they are.

With knowledge of this practice becoming widespread and accusations flying, investors have started to demand more granular insights into whether the strategies and products they are being sold are as sustainable on ESG principles as reported.

Investors now want definitive answers about exactly how a fund or strategy is seeking to address ESG principles, and whether active steps are being taken by companies being invested in to reduce their carbon footprint, and improve diversity, amongst other factors. It all boils down to being able to answer one question from factsheets to reports: ‘How does this fund make the world a better place?’

3. Is your ESG data up to scratch?

The regulatory environment continues to tighten, and investors are demanding ever more transparency. That means there is a need for the quality and quantity of ESG data to continue improving as reporting requirements grow.

To date, there has been a lack of standardised reporting frameworks around ESG metrics, making it difficult for investors to compare data on ESG progress, risks, and opportunities. As regulation comes into force and the shift towards clear definitions and comparable data takes place, standardisation will help investors better understand ESG metrics and make it easier for asset managers to report – if they have the requisite data.

4. Are there headwinds ahead for ESG?

Although inflows to ESG funds have continued to grow, there are signs of headwinds in 2022. The rapid growth of ESG funds may start to slow if they start to underperform benchmarks as investors react defensively to market instability.

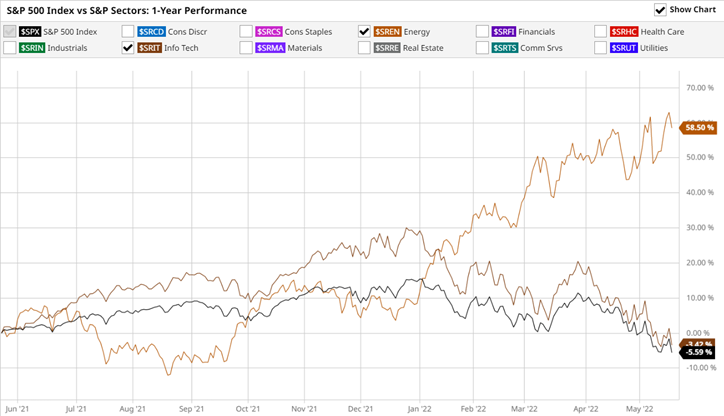

To date, many ESG funds have been heavily weighted in high-performing tech stocks, but there are signs of tech stock selloffs in recent months.

It is also not uncommon for ESG funds to be underweight in energy and mining stocks, if they are included at all. But energy stocks represented the top performing sector in the S&P 500 in 2021 and have seen a resurgence in the face of geopolitical instability in Europe in 2022.

Wider market trends could still shape the growth of ESG in 2022 yet.

S&P 500 Index performance, inc. Energy and Tech sectors

Source: https://www.barchart.com/stocks/market-performance

A data-driven future for ESG reporting

Despite signs of possible headwinds, there is no doubt that ESG is here to stay, and regulation will only continue to tighten. And firms must address the data and reporting challenges that new regulation is bringing.

The move towards increased transparency will continue, given investment reporting can provide the lens through which companies can be held accountable for their ESG efforts. To meet these new reporting needs, broader data sets will be required to cover the full breadth of ESG risks, issues, policies, process, and performance-related indicators.

Although climate change is likely to be seen as the highest priority, expect an increase in data relating to nature and human rights risks. As the volume of data grows across the ESG spectrum, it is important to remember that quantity does not always equal quality, implementing standardised reporting to promote trust and confidence is still very much a work in progress. But the onus is on asset managers to keep up with what is a fast-moving subject and build their investment reporting technology stack to evolve in tandem.

Related Content

The data problem behind SFDR reporting and disclosures

SFDR is one of the largest pieces of ESG-related legislation rolled out anywhere in the world, and their compliance requirements are a daunting prospect for fund managers and wider financial market participants.

Under Level 1 of SFDR, market...

The asset manager’s how-to guide to ESG reporting

There has been an explosion in the popularity of environmental, social, and governance funds in recent years. In light of this growth, fund managers have been increasingly keen to step up their commitment to ESG and its measurement.The rewards for...

SFDR Article 6, 8 and 9 products explained. What do the classifications mean?

The EU has started to implement the Sustainable Finance Disclosure Regulation (SFDR), which sets out rules for classifying and reporting on sustainability and ESG factors in investments.

Forming part of the EU Financing Sustainable Growth Action...