Written by Landytech

21 Jun 2022When it comes to reporting, many firms still rely on outdated technology and legacy systems. Combining data from multiple sources and offline spreadsheets is an inefficient process that takes far too long, is highly prone to manual errors, and limits reporting flexibility.

It is no revelation that clients are increasingly savvy investors, and at a time of increasing market volatility and industry competition, expectations are soaring. Clients want on-demand, granular reporting, and legacy processes are straining under the pressure.

Through conversations with asset and private wealth managers, we have identified six key requirements for creating investment reports that clients love. Read on to find out what they are.

Visual appeal - Let data tell the story

Clients now interact with well-presented information daily, and are accustomed to visually compelling charts, graphs, and tables in other areas of finance, such as online banking. Investment performance and risk reporting needs to match up to this experience.

It is essential to have a variety of visual components relevant to the reporting topic, being able to switch quickly between pie charts, bar charts, and tables depending on the data being displayed. Kathleen Henrick, Landytech’s Client Operations Director, notes “something I hear a lot when Landytech onboards new clients is that they want to make their reports much more visually interesting, turning certain tables they see as ‘boring’ into pie charts and bar charts instead.”

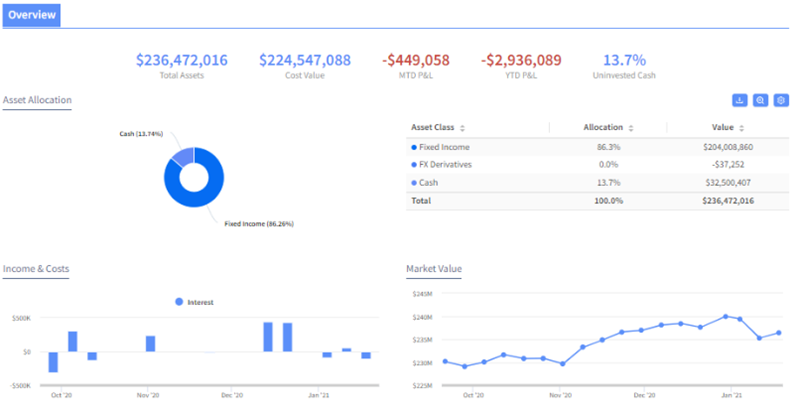

The ability to clearly illustrate historical AUM is also crucial for both asset and private wealth managers. In asset management sales, it can be a very persuasive metric to show in pitch decks, visualising the growth of a fund in a way that is easy to understand. For private wealth managers it can give clients a clear picture of how their wealth has grown over time. As one CEO of a family office put it, "that is the line everyone wants to see - so powerful."

Historical AUM visualised in a performance report

Multi-channel – Fuelling the conversation

As investors become increasingly digitally savvy, investment managers must accommodate both online and offline communication channels. This is particularly the case for private wealth managers, where different generations may have conflicting preferences for how they want to receive information.

Nevertheless, all clients will begin the conversation in one channel. It is the ability to carry this conversation on in a different channel, with the same information and without wasting any time, that is essential.

The demand for multichannel delivery requires firms to use technology that can handle online and offline reporting consistently. Clients now expect a service that delivers a unified experience with minimal delay and friction.

24/7 Access - Reporting never sleeps

It is no longer enough for clients to have to wait a whole reporting period before they get an updated picture of performance and risk, they want to see information in an online dashboard in the meantime, providing them with a refreshed daily view.

There is now a clear expectation that clients should have 24/7 access to this information, which raises the bar for investment reporting platforms significantly. As clients continue to take a more direct role in monitoring investments, the platform must be user-friendly, self-directed, and rich in value and functionality.

As demands for access increase, so does the expectations of reporting frequency. The old model of quarterly reports printed and sent through the mail is not dynamic enough to meet the needs of today’s investors.

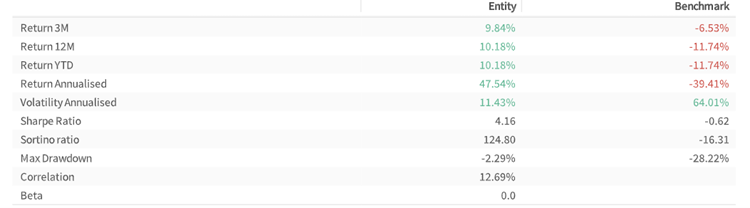

As frequency grows, it means the ability to visualise and report with timeliness on MTD, QTD, and YTD performance is now table stakes. To do this you will need to have all relevant performance calculations handy.

Performance metrics in a report for a multi-strategy fund

Scalability – Removing the bottleneck

If reporting still relies on manual processes , responding to ad hoc requests and onboarding new clients can quickly create a bottleneck, especially where a dedicated IT team is needed to develop and customise new reports.

Without a scalable reporting tool, even more valuable resource is wasted as managers get tied up chasing compliance requirements and compiling reports – time better spent building scalable practices.

As greater emphasis is placed on service differentiation and client retention, reporting needs to be flexible to include any metrics or analysis the client may be interest in seeing.

To counteract these challenges, new reporting platforms are emerging to support firms in their efforts to scale and grow. They can connect to multiple data sources, minimise human error and boost the ability to deliver a standout reporting service on a larger scale, through drag-and-drop functionality that does not require an IT specialist. As many firms move on to these platforms, robust reporting through an interactive online portal is quickly becoming an essential part of a comprehensive investment management offering.

If moving onto a reporting platform, to keep the reporting experience consistent for clients, it is essential reports can be tailored to your brand guidelines. "The ability to customise client reports in line with marketing and branding expectations makes for a hugely powerful resource", comments Kathleen.

An example of an asset allocation report for a family office

Flexibility – different horses for different courses

There is a growing need for flexibility in investment reporting and having different types of reports available depending on varying use cases is now essential.

Firms need to have a professional and visually appealing factsheet for the sales team, but also need a robust consolidated report as a supporting resource. Whilst prospects will be much more interested in the initial factsheet, existing investors will want the more detailed understanding of performance and risk.

Security – Sleeping soundly at night

Clients want access to flexible and interactive online dashboards and reports, but it is only natural that managers worry about security and protecting client data. The reporting solution needs to ensure that both requirements can be met, whether it is outsourced or built in-house.

Platforms should provide sufficient control and transparency of reporting processes, including a full history that can be used for auditing purposes. A fit-for-purpose reporting platform should give you the ability to manage report distribution, flexibility, and a secure web portal to keep your clients’ data safe from breaches.

A paradigm shift for investment reporting

To date, reporting has been a delivery mechanism for historical information, distributed on a periodic basis, predominantly in offline form. But this approach is quickly becoming obsolete and managers that do not change with the times will not keep up.

By selecting an intuitive and interactive web-based platform with a report builder, where strong IT skills are not a prerequisite, any asset or private wealth manager can create beautiful and fully customisable reports and let data tell the story.

Today's investment reporting platforms provide near real-time access to performance and risk data and reports. With a fully digitalised platform, reporting can become so much more than just stale, one-way broadcasting. It can facilitate the on-demand and dynamic reporting that today’s investors expect.

If your firm is considering an upgrade to its reporting platform, find out more from one already reaping the benefits.

Related Content

.png)

How Landytech is Revolutionising Client Reporting in the Investment Management Industry

Following Landytech's recent win in the Client Reporting category at the WealthBriefing Channel Island Awards, our COO, Gregory Chouette, had the pleasure of sitting down with Clear Path Media, the organisers of the awards, for an interview. In the...

The Future of Family Office Reporting

Once confined to a world of spreadsheets and static presentations, family office reporting is beginning to take on a radically different form as automated data consolidation and near-real-time portfolio monitoring become the norm.

In recent years,...

How Sesame Revolutionises Reporting for Family Offices

As family portfolios become more complex and the data burden increases, family office staff are increasingly bogged down in spreadsheets and legacy systems that struggle to keep up. And as families become exposed to more and more sophisticated...