Written by Landytech

10 Feb 2023The investment management industry is one of the most data-intensive in the world. Yet with manual processes still commonplace, accessing and leveraging this vast data for efficient and robust front, middle, and back-office workflows is still not the norm. But things are changing. As the industry accelerates its digital transformation, the use of APIs to streamline data flows is becoming table stakes.

API technology is the cornerstone for building advanced data management capabilities. It facilitates rapid and automated transfer of standardised and enriched data, whilst enforcing high standards of security throughout the process and removing risks associated with manual processes.

Without it, firms across the asset and wealth management spectrum often struggle to achieve timely and accurate portfolio analysis and downstream reporting. And with allocator and regulator requests for greater transparency and granular reporting only increasing, manual data management is quickly becoming obsolete.

As fast, sophisticated data management becomes business critical, these benefits of leveraging a data APIs are crucial to unlock for your firm.

1) Save time and resources

Ever-increasing amounts of data are needed to fulfil the reporting requirements of clients and regulators. Manual data sourcing and aggregation struggle to provide the accurate and timely input required to respond quickly to demands.

An API can automate and standardise this process, ensuring that any data used for downstream reporting is aggregated and standardised quickly, whilst also going through a validation process to ensure accurate reporting. In human resource terms, this means there is no need to incur ever increasing costs for data entry and data reconciliation roles, as internal systems are automatically in sync.

If your company is struggling to spend time on revenue-generating activities, the time cost associated with manual and repetitive data management tasks becomes even more painful. A data API can help to drive productivity and performance by freeing up time for business development initiatives.

There are also savings to be made on costly licenses from industry-standard data vendors instead leveraging them through data management providers without incurring additional costs.

2) Seamlessly feed data into internal systems

Data that has been sourced manually often comes in multiple formats and is difficult to consolidate. This can make feeding directly into internal portfolio management and reporting systems more difficult. There is also the additional step of manually validating data before it can be used for downstream reporting, which adds additional time to the process. After all this has been completed, the datasets are often no longer in sync with the most recent version, impeding the ability to make informed investment decisions on up-to-date information.

Data that has been aggregated, normalised and delivered with an API will seamlessly integrate with your internal systems and any further applications used for reporting and monitoring. All data can also be available on a t+1 basis, whereas manual data extraction can mean datasets are between 15 and 30 days old by the time it can even be retrieved at source.

There is also the option of setting the cadence of your API calls to suit your business needs. For family offices and asset managers, this means the ability to seamlessly integrate portfolio metrics and risk analytics, refreshed daily. For fiduciaries, this means the ability to feed data directly into internal accounting systems on a monthly or quarterly basis.

Opting for an API-based data management solution ensures that you retain the ownership of data. The friction of managing relationships and connectivity with custodians is managed by the vendor, while the client always maintains data ownership. Retaining proof of that ownership can be crucial to stay in check with the regulators in some jurisdictions.

3) Improve data integrity

Problems with accuracy and unicity usually start in the data collection phase, with investment managers facing an uphill battle juggling multiple data sources, feeds and formats. The subsequent complexity of inputting and storing this data in internal systems, means firms often lack a single source of truth for portfolio management and reporting.

By connecting to an API, data will arrive from a single source feed, having been standardised and validated at source. Any cases of missing or incorrect data will have been flagged and notified before the data reaches internal systems. Using the same datasets across the organisation also significantly improves unicity in downstream reporting, which is crucial for credibility with clients and staying in check with the regulator.

4) Reduce operational risk

Automated data processing via an API can ensure there is less room for human error in reporting, in addition to ensuring timely responses to client and regulator demands. A single feed of standardised data into internal systems saves time and risks associated with manual processes. There is also a clear trail of when data was input into the system, useful for regulatory audits and for client purposes if there is a request for granular data.

Maintenance responsibilities for data pipelines are also shifted from internal IT teams to vendors. This can save the firm from downtime experienced during software upgrades, in addition to comprehensive access to business continuity and backup services, which minimise both the impact of disruption and possibility of data loss.

5) Scalability

Industry competitiveness is fiercer than ever. Firms need scalable solutions to help them grow and attract capital, and APIs provide the data flows that underpin this growth. Imagine being able to onboard a client using banks or custodians you do not yet have a relationship with, and immediately being able to report on the assets held by them. Leveraging a data manager’s existing relationships with vendors and custodians makes this achievable.

APIs also enable firms to improve their product offering, throwing off the shackles of cumbersome manual processes and facilitating the development of transparent and granular analytics and oversight tools accessible to clients. At a time where service levels are increasingly under the microscope this can be a key source of differentiation.

Moving on up with APIs

Investment managers are overloaded with options that enable them to automate data management processes. APIs can take on the most intensive parts of the process from data sourcing to standardisation and enrichment, without the large costs associated with full system implementation. They are an integral resource that increases quality of data, streamlines internal processes, and empowers your team to focus on more value-added initiatives that fuel growth.

Collecting data from a range of sources, formats, and systems comes with inherent challenges. You need standardised, consistent data to make your system the source of truth for internal and external stakeholders.

Related Content

%20(1).png)

Unlock bookkeeping efficiency with Sesame Data - and offset implementation costs with the Jersey Better Business Grant

For trust companies, efficiency and accuracy in bookkeeping are paramount. Yet, many trust companies in Jersey still rely on manual processes that consume valuable time and resources. Enter Sesame Data, an innovative solution designed to automate...

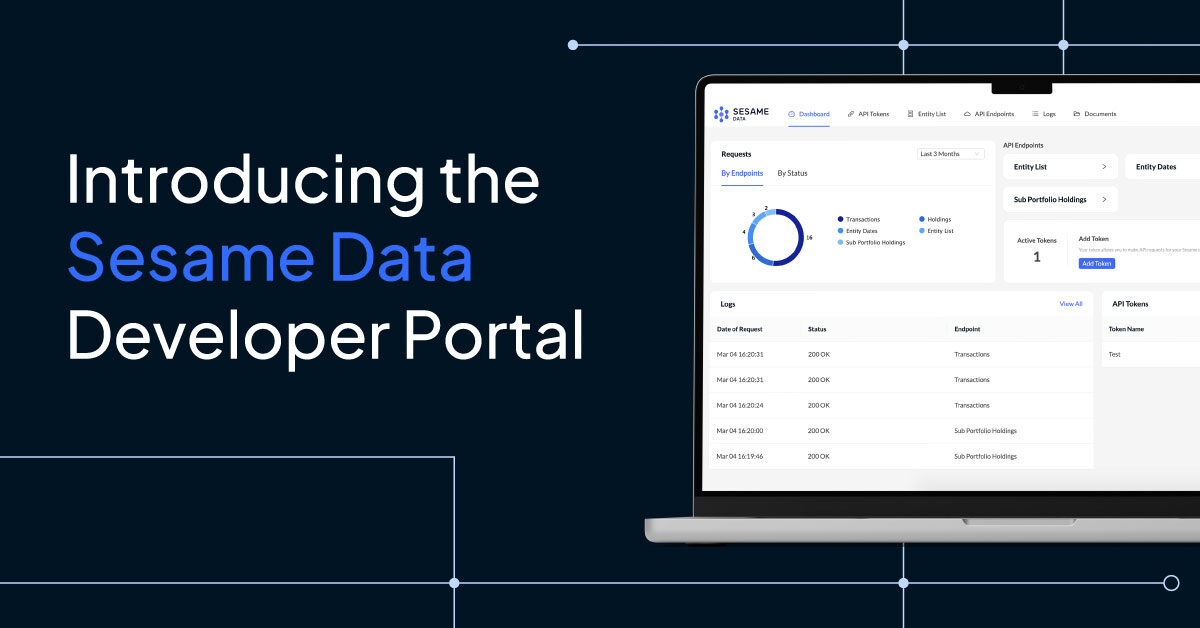

Ensure Faster API Integration With The Sesame Data Developer Portal

Discover the power of seamless custodied investment data integration with the launch ofthe Sesame DataDeveloper Portal. The portalis designed to empower developers with theAPI tools, documentation and resources necessaryto streamline...

Top 5 Family Office Data Challenges in 2023

In recent years, a key driver of family office investment in technology has been the need to have immediate access to near real-time performance data, to uncover operational efficiencies and provide consolidated reporting to families.

Whilst legacy...