.png)

The all-in-one platform for managing multi-asset portfolios

To access our full content library, head over to our resources page

Sort by

.png)

.png)

.png)

.png)

.png)

%20(1).png)

.png)

.jpg)

.jpg)

-1.jpg)

/Blog%20and%20content%20images/Private-Asset-Reporting-Blog_v01.jpg)

.jpg)

/Blog%20and%20content%20images/Performance-and-risk-analytics-Blog.jpg)

/Blog%20images/Cloud-based-investment-management-software%20blog.jpg)

.png)

Following Landytech's recent wins in the Client Accounting and Client Reporting categories at the 2025 WealthBriefing Channel Island Awards, Benjamin Mouté, CEO and Founder of Landytech, sat down with WealthBriefing to explain how collaboration, innovation and a culture of continuous improvement are reshaping accounting and reporting for the trust sector.

Read more.png)

In the December 2025 issue of the We Wealth Family Office & Family Business magazine, Landytech CEO Benjamin Mouté shares his insights on how digital platforms are reshaping family wealth management, helping Italian Family Offices gain clarity, control and transparency over increasingly complex, multi-asset and multi-jurisdictional portfolios.

The original article in Italian can be accessed on the We Wealth website here.

Read more

We're proud to announce that Landytech has been named winner in both the ‘Client Accounting’ and 'Client Reporting' categories at the 2025 WealthBriefing Channel Island Awards.

(L-R) Landytech's Ben Goble, Hugh Porter and Matthew King accept the Client Reporting and Client Accounting awards at the 2025 WealthBriefing Channel Island Awards in Jersey

(L-R) Landytech's Ben Goble, Hugh Porter and Matthew King accept the Client Reporting and Client Accounting awards at the 2025 WealthBriefing Channel Island Awards in Jersey

These awards are a testament to our commitment to transforming trust company and family office bookkeeping processes with Sesame Data, our API solution that automates bookkeeping with a single feed of aggregated and standardised custodian data, delivered seamlessly into internal ERP or bookkeeping systems, enabling greater operational efficiency and scalable data management.

The WealthBriefing Channel Islands Awards are part of a global programme run by WealthBriefing and its sister publications WealthBriefingAsia and Family Wealth Report, encompassing all the world’s major wealth management centers.

Participants around the world recognise that winning awards is particularly important in these challenging times as it gives clients reassurance in the solidity and sustainability of the winner’s business and operating model.

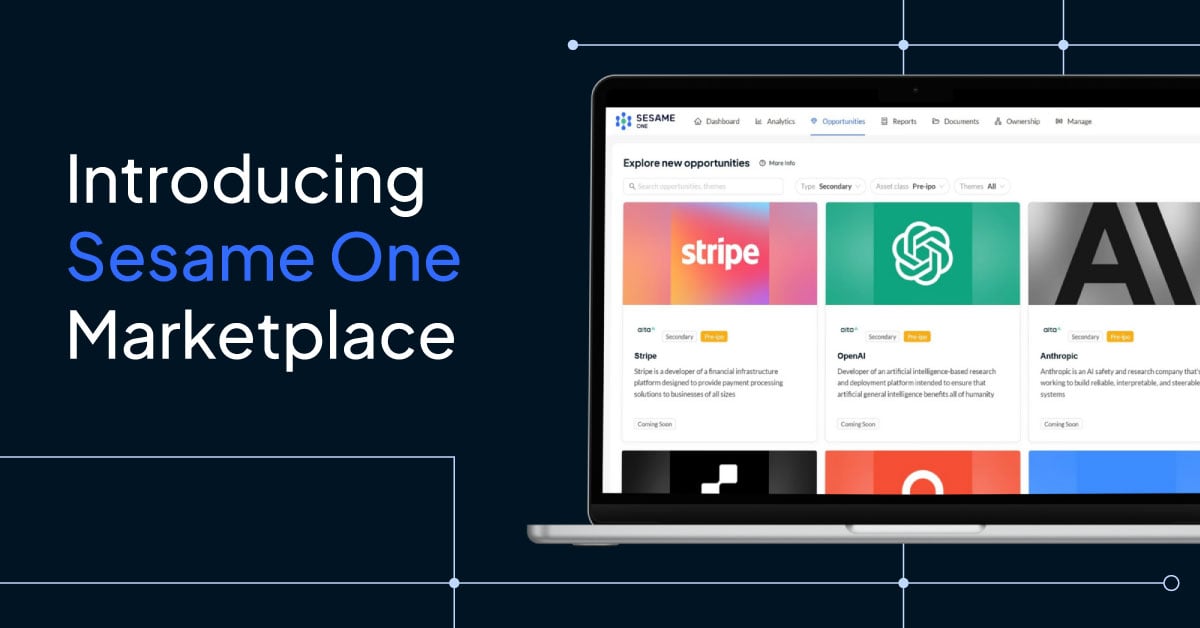

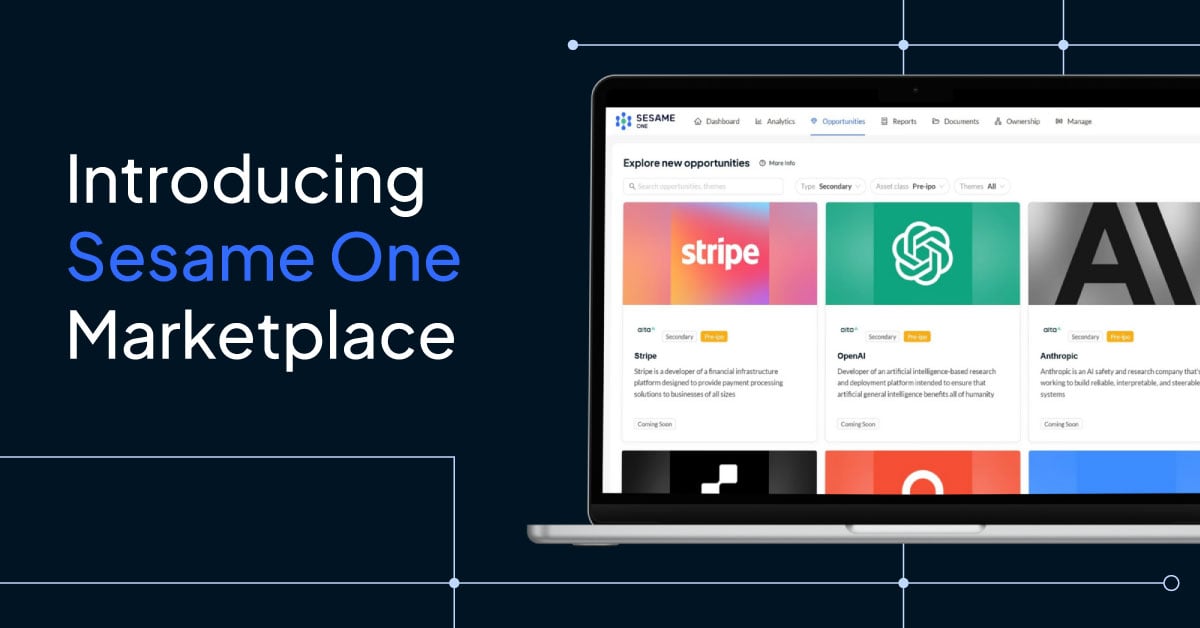

For decades, family offices have relied on trusted relationships and private networks to access opportunities in alternative investments. Introductions from peers, long-standing fund manager connections and closed-door referrals have formed the foundation of deal sourcing.

Read more

Alternative investments are becoming an increasingly important part of family office portfolios. As allocations grow, so does the challenge of finding high-quality opportunities that are relevant to each family’s investment strategy and tailored to their specific needs.

Read more.png)

.png?width=1200&height=628&name=Attachment%20(2).png)

London, 16th October 2025 — Landytech, the investment technology provider powering operational efficiency and informed investment decision-making for leading wealth owners and their advisors, today announced its successful completion of its SOC 2 examination as of 16th October 2025 and includes the following scopes:

Read more

.png)

London, Wednesday 2nd July 2025 - Quantios, the leading SaaS provider to the wealth, trust, and corporate services industry, today announced a strategic partnership with Landytech, the investment technology company behind Sesame Data, a powerful suite of API solutions. This partnership will give Quantios Core customers the power of Landytech's data aggregation, analytics and reporting capabilities, further enabling digitalisation across trust administration processes.

The first phase of the collaboration, launching in August, will allow Quantios Core customers to benefit from bookkeeping automation via a native connector between Quantios Core and Sesame Data's custodian data API, enabling data from over 500 global custodians, banks and investment managers to flow seamlessly into the trust company's single source of truth.

The connector will accelerate Sesame Data implementation and time to value, with seamless mapping of clean and standardised transaction data from multiple sources to client entities within Quantios Core, significantly reducing manual data entry in bookkeeping.

Read more.png)

%20(1).png)

%20(1).png?width=657&height=438&name=Untitled%20design%20(11)%20(1).png)

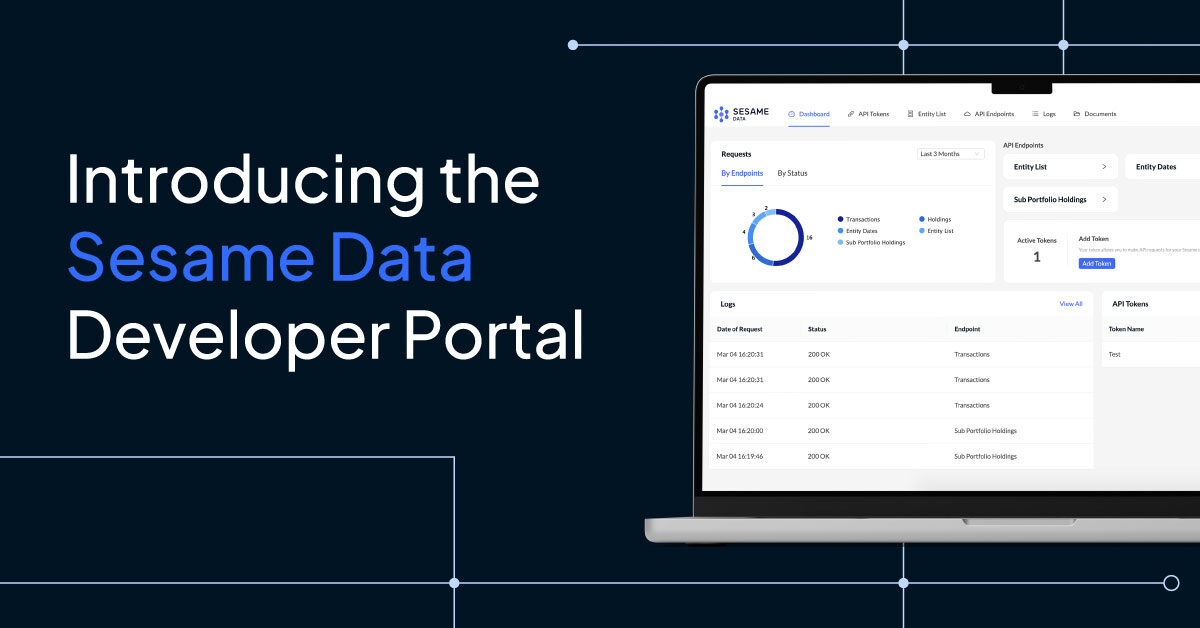

For trust companies, efficiency and accuracy in bookkeeping are paramount. Yet, many trust companies in Jersey still rely on manual processes that consume valuable time and resources. Enter Sesame Data, an innovative solution designed to automate and streamline bookkeeping, offering unparalleled productivity gains and operational efficiency.

Read more

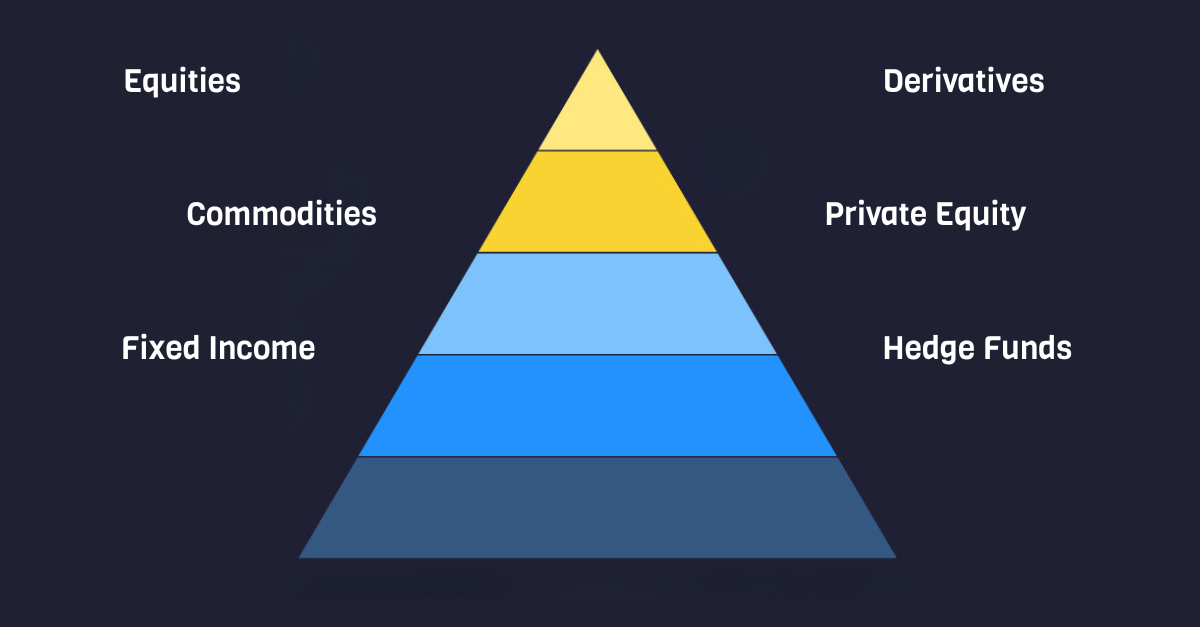

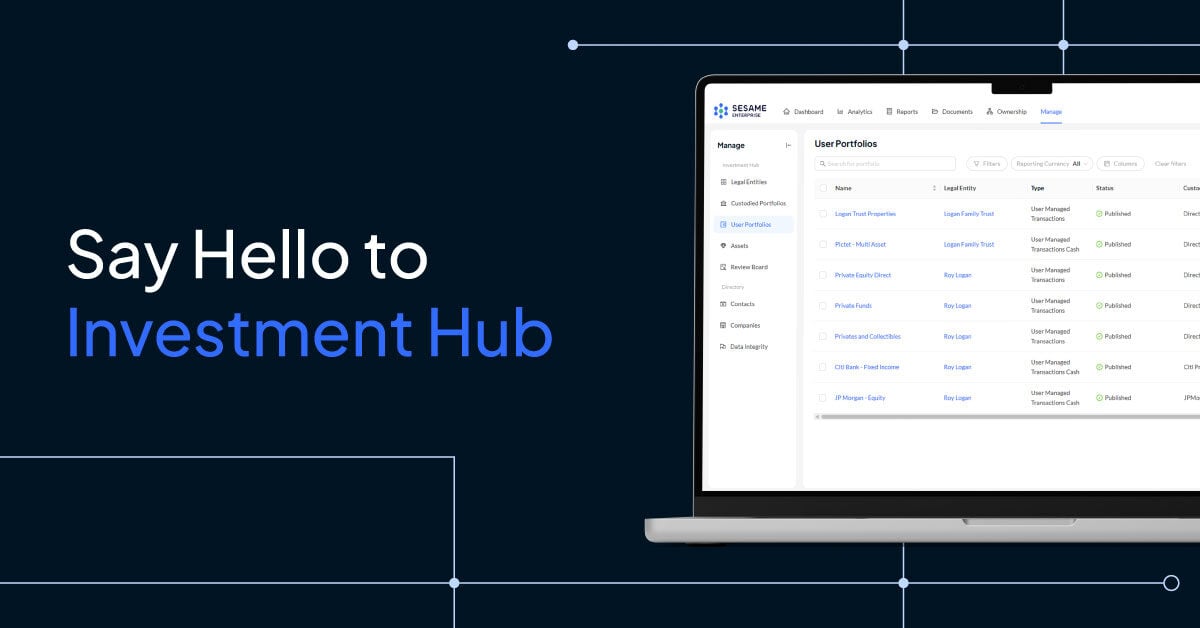

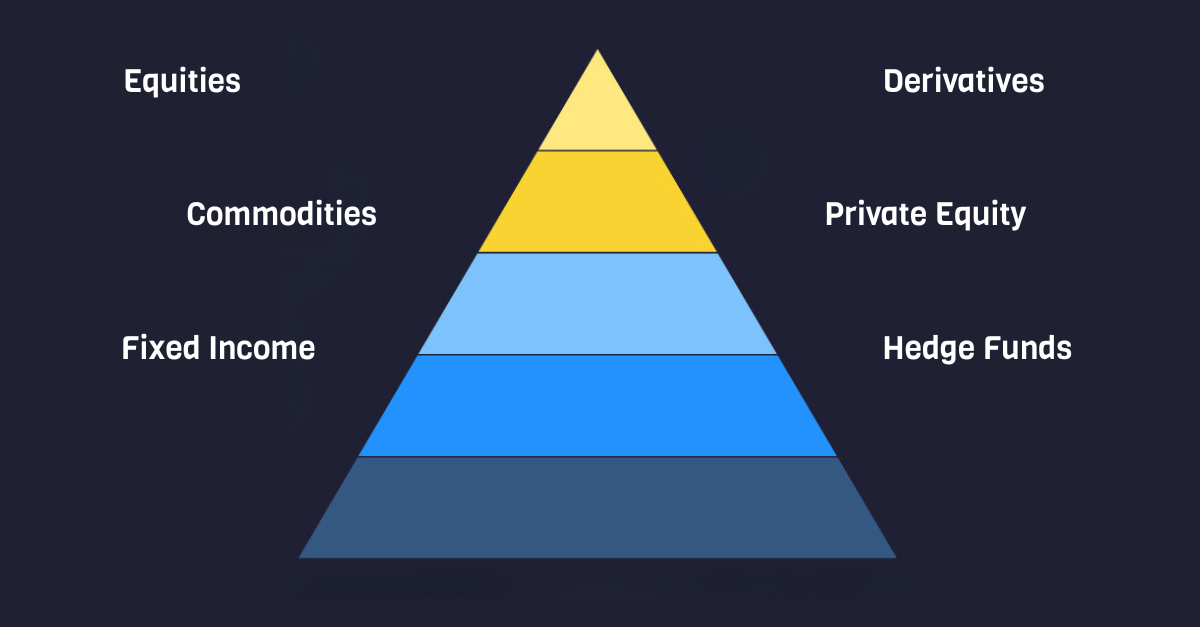

Ultra-high-net-worth families and institutional asset owners typically have portfolios that span multiple asset classes, data sources and currencies, and these investments may be spread across various legal entities such as holding companies, operating companies, trusts and foundations. This complexity makes creating a single source of truth difficult and time-consuming. Not only does this impact operational efficiency, but it can also have consequences for decision making that could ultimately lead to unexpected losses.

Read more

We're thrilled to announce that Landytech has been named winner in the ‘Client Accounting’ category at the WealthBriefing Europe Awards 2025.

Landytech's Gregory Chouette and Amy Allpress accept the award for Client Accounting at the 2025 WealthBriefing European Awards Gala

Landytech's Gregory Chouette and Amy Allpress accept the award for Client Accounting at the 2025 WealthBriefing European Awards Gala

This award is a testament to our commitment to transforming trust company and family office bookkeeping processes with Sesame Data, an API that automates bookkeeping with a single feed of aggregated and standardised custodian data, delivered seamlessly into internal ERP or bookkeeping systems, enabling greater operational efficiency and scalable data management.

The annual WealthBriefing European Awards program recognises the most innovative and exceptional firms, teams and individuals. The awards have been designed to showcase outstanding organisations grouped by specialism and geography which the prestigious panel of independent judges deemed to have ‘demonstrated innovation and excellence during the last year’.

Each of these categories is highly contested and is subject to a rigorous process before the ultimate winner is selected by the judges. It is this process that makes WealthBriefing awards so prized amongst winners.

We are excited to announce our partnership with Dexbridge Capital, uniting deep investment advisory expertise with our cutting-edge analytics and reporting platform for family offices. By leveraging Sesame for Partners, this collaboration will deliver a combined solution that streamlines data aggregation, analytics and reporting, empowering mutual family office clients to manage complex, multi-generational wealth with more confidence and precision than ever before.

Through this alliance, clients can expect:

Landytech, an international provider of cutting-edge data aggregation and analysis services and creator of Sesame, an investment management platform for asset owners, managers and advisors, today announced a new relationship with Ocorian, a market leader in asset servicing for private markets, corporate, and fiduciary administration.

Ocorian will adopt the Sesame Enterprise platform to deliver a comprehensive reporting and analytics solution to their single-family office clients and leverage Sesame Data to automate bookkeeping and portfolio monitoring processes, differentiating their client-centric offering for private clients.

London-based Landytech has grown to a team of 120 staff in just five years, serving clients in over 30 countries. Sesame supports $100bn in assets under reporting, with direct connections to 500-plus custodians and access to 10,000- plus financial institutions through Open Banking APIs.

Trustee clients using Sesame have cut report preparation time by 80%, delivering higher-quality, more comprehensive reports and setting a new benchmark for efficiency and excellence. Landytech’s solutions directly tackle resource-intensive and time-consuming manual bookkeeping while streamlining delivery of client reporting and providing clients with timely and precise data.

The world of alternative investments is complex, fast-paced, and data-intensive. Managing and extracting information from private fund transactions, quarterly investor reports, and intricate investment agreements can be a slow, error-prone, and inefficient process.

In a fast-moving industry where precision and speed are non-negotiable, outdated document workflows create unnecessary risks and delays. Enter Sesame Doc AI, a revolutionary AI-powered solution that transforms how investment professionals manage alternative investment documents.

.png)

Following Landytech's recent win in the Client Reporting category at the WealthBriefing Channel Island Awards, our COO, Gregory Chouette, had the pleasure of sitting down with Clear Path Media, the organisers of the awards, for an interview. In the discussion, Gregory shares insights into the foundations of our success, the challenges we’ve overcome and our vision for the future of wealth management.

Read more

Leading wealth management industry participant, Landytech, has been selected as a winner in the ‘Client Reporting’ category at The WealthBriefing Channel Islands Awards 2024.

Showcasing ‘best of breed’ in the Channel Islands region, the awards have been designed to recognise outstanding organisations grouped by specialism and geography which the prestigious panel of independent judges deemed to have ‘demonstrated innovation and excellence during the last year’.

Each of these categories is highly contested and is subject to a rigorous process before the ultimate winner is selected by the judges. It is this process that makes WealthBriefing Channel Islands awards so prized amongst winners.

The WealthBriefing Channel Islands Awards are part of a global programme run by WealthBriefing and its sister publications WealthBriefingAsia and Family Wealth Report, encompassing all the world’s major wealth management centers.

We're proud to announce that Landytech was named "Risk Management Software of the Year" at the 2024 Hedgeweek European Emerging Manager Awards.

This recognition underscores our commitment to empowering hedge funds with cutting-edge tools to navigate and leverage risk analytics and reporting with confidence and precision.

For over a decade, the Hedgeweek European Emerging Manager Awards program has recognised excellence in fund performance and service provision within the emerging investment management industry. We are incredibly grateful to everyone who voted for us in the risk management software category; thank you for your support.

Winners were announced during the awards ceremony in London on 14th November 2024.

(L-R) Landytech's Max Wilson, Cathal Dennehy and Amy Allpress accept

(L-R) Landytech's Max Wilson, Cathal Dennehy and Amy Allpress acceptRead more

At Landytech, we are passionate about empowering asset stakeholders by revolutionising access to investment data and insights in one central platform. Today, we’re excited to announce the launch of our new Partner Programme—a strategic initiative designed to forge stronger, mutually beneficial relationships with partners across the investment management ecosystem. This programme is more than just a collaboration; it’s a growth opportunity for both Landytech and our partners, driven by shared success, innovation, and impact.

Read more

Sesame is a living ecosystem that constantly evolves to meet the changing needs of asset owners, managers and advisors. Regular updates are a core part of this evolution, to ensure that you can benefit from the latest innovations and improvements. And today we are announcing our biggest product release since we launched Sesame 3.0.

Five years ago, we brought Sesame to market with two core principles in mind. We wanted to automate the manual, tedious data tasks that hold asset owners, advisors and manager back, by providing the most comprehensive analytics and reporting platform in the market. And we wanted to provide these capabilities with a user experience that investment professionals would love.

These principles are helping us usher in a new era of investment management technology. And are the key reason this release includes a tool that allows you to interact with and analyse your data like never before, in addition to making the platform even easier to use. All on a foundation of industry-leading data integrity and security protocols.

Here are the new features we are very excited to be launching:

Read more

By adopting the Sesame platform developed by the European financial technology provider, Scouting will implement its data aggregation and analytics offering for families and work on the creation of an international Family Office community.

Read more

In the rapidly evolving world of investment management, data has become the new currency. At Landytech, we are committed to empowering asset owners, managers, and advisors with innovative technology that transforms complex, multi-asset data into actionable insights across the entire portfolio. As we continue to lead the industry as the best-connected investment management platform in Europe, we are excited to unveil our comprehensive brand refresh, designed to reflect our growth, vision, and technology-first approach.

Read more

Landytech, the leading European investment management platform, is proud to announce that it has recently been awarded ISO 27001 certification, an accreditation that reinforces its ongoing commitment to the highest standards of information security.

Read more

As market volatility returns with a vengeance, an institutional-grade risk function is now a critical factor in investors’ allocation decisions.

Read more

The highly anticipated Sesame 3.0 is here.

Since we launched Sesame in 2019, Landytech has been on a mission to revolutionise the tools used for investment analysis and reporting, tackling the unique technical challenges that investment professionals face.

Over the past 4 years, our team has worked tirelessly to build a platform that provides you with a tool for automated data consolidation, enhanced portfolio analytics and streamlined report creation.

We envisioned Sesame 3.0 long before launching 2.0, and now, the next generation investment management platform is here to solve the most pressing challenges faced by today’s asset owners, managers and advisers.

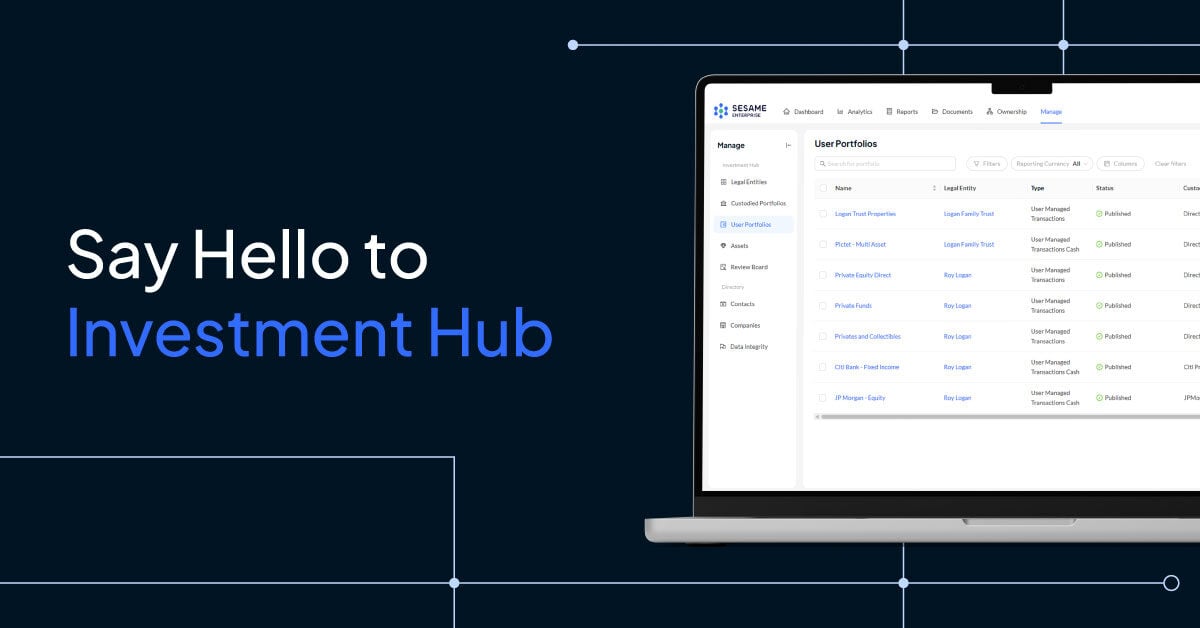

To date, investment analysis and reporting have driven our platform’s success. But we realised that our users needed more: a central platform for all their day-to-day investment management operations. A source of truth not just for investment data, but all related information so that everyone in the team can access critical context and records in one single place.

The launch of Sesame 3.0 marks a fundamental shift, making Sesame your command centre for investment management. It’s better connected than ever, with a revolutionary new reporting tool and a completely new way for you to drive collaboration across your team. Discover the capabilities that have made us so excited to announce Sesame 3.0:

Read more

Landytech is delighted to be featured as one of the global leaders in family office technology in the 2023 Forbes Family Office Software Roundup.

The roundup highlights companies supporting the core functions of data aggregation, day-to-day management, and reporting. Many family offices refer to the Forbes shortlist of providers as an invaluable resource when choosing a technology partner.

.jpg)

Discover how a London-based multi-family office upgraded from an Excel-based ledger system to Sesame, saving days each month on data consolidation and reporting that could be reallocated to business growth initiatives.

With the previous system, staff were manually updating transactions and valuations across hundreds of accounts. This left little time for high-touch client interactions and business development and the intensive workload meant reporting only covered net worth and not profit and loss.

Now, the family office receives an automated feed of consolidated data from all associated banks and custodians, refreshed daily. Client reports can be produced at the click of a button and tailored on the fly, meaning the team can now focus on strengthening client relationships and expanding business development.

Read more

Risk management is a complex domain of expertise. Navigating today’s fast-paced and volatile markets with confidence and clarity takes a proven infrastructure, along with specialised risk and technology skillsets to deliver the timely insights needed to make investment decisions quickly and provide the high-quality reports allocators expect.

Right from inception, asset managers need a robust, institutional-grade risk management capability to attract investor allocations and meet clients’ ongoing demands. Without one, you likely won’t even make it through the due diligence process. But what does an in-house risk management and reporting function need to have in practice?

Read more

As today’s UHNW become more geographically dispersed and family offices become more sophisticated in their investment functions and allocation strategies, portfolios now consist of multiple asset classes, custodians and currencies, and investments may be spread across various legal entities such as trusts, LLCs, foundations and personal accounts.

In this world of increasing complexity, family offices must grapple with vast quantities of disparate datasets to build a complete and accurate picture of overall wealth, portfolio performance, risk and exposure. For family offices to make informed investment decisions on such complex portfolios, timely, accurate and comprehensive reporting is critical. But creating this kind of rich, consolidated reporting can be a challenge when data is being sourced manually. It relies on family offices being able to source high-quality data, transform and store that data in a usable format, and enrich it with information from market and reference data vendors.

In an era where access to timely and accurate data is paramount, the inefficiencies and risks associated with manual data sourcing hinders the ability of family offices to make informed investment decisions and ensure wealth is preserved for future generations. Here we look at the sourcing options available to family offices and how they can build scalable data processes that will serve them long into the future.

Read more.jpg)

Trustees have a core fiduciary duty to act in the best interests of their beneficiaries. In order to do so, they must gain an understanding of their long-term goals and aspirations. This is particularly important when it comes to investable assets.

Read more-1.jpg)

As family offices attempt to modernise, many are facing productivity challenges due to out-of-date, disparate internal systems and heavily manual processes. Naturally, there are inherent risks associated with such inefficiencies, including missed investment opportunities, staff dissatisfaction and operational risk.

Read more

In the face of fierce industry competition and regulatory pressures, trustees today face a squeeze on fees and significant margin pressures. It is forcing them to find operational efficiencies and differentiate their offering in a way that enables them to protect and increase their margins.

Read more

In a rapidly evolving landscape, asset managers are increasingly relying on risk management providers. Meeting regulatory expectations and the needs of increasingly demanding investors means that finding the ideal partner is more important than ever.

Read more/Blog%20and%20content%20images/Private-Asset-Reporting-Blog_v01.jpg)

The role of a trustee is a complex one, and as the world grows increasingly digital, managing assets and ensuring the proper administration of trusts can be an arduous task. In the face of fierce industry competition, trustees are looking for ways to reduce their operating costs and increase their margins. One way for trustees to get ahead is with interoperable data. In this blog, we will delve into the concept of interoperable data, its benefits, and why it is essential for trustees to harness the full power of their data.

Read more

.jpg)

In recent years, a key driver of family office investment in technology has been the need to have immediate access to near real-time performance data, to uncover operational efficiencies and provide consolidated reporting to families.

Read more

Competitive market pressures are stronger than ever, and volatility looks here to stay for a while yet, putting the onus on smaller and emerging asset managers to find new ways to adapt. As firms reassess operating models with urgency and look to differentiate their service against a backdrop of sustained pressure on fees and shifting investor product demand, what are the top 10 trends shaping the asset management industry in 2023?

Read more

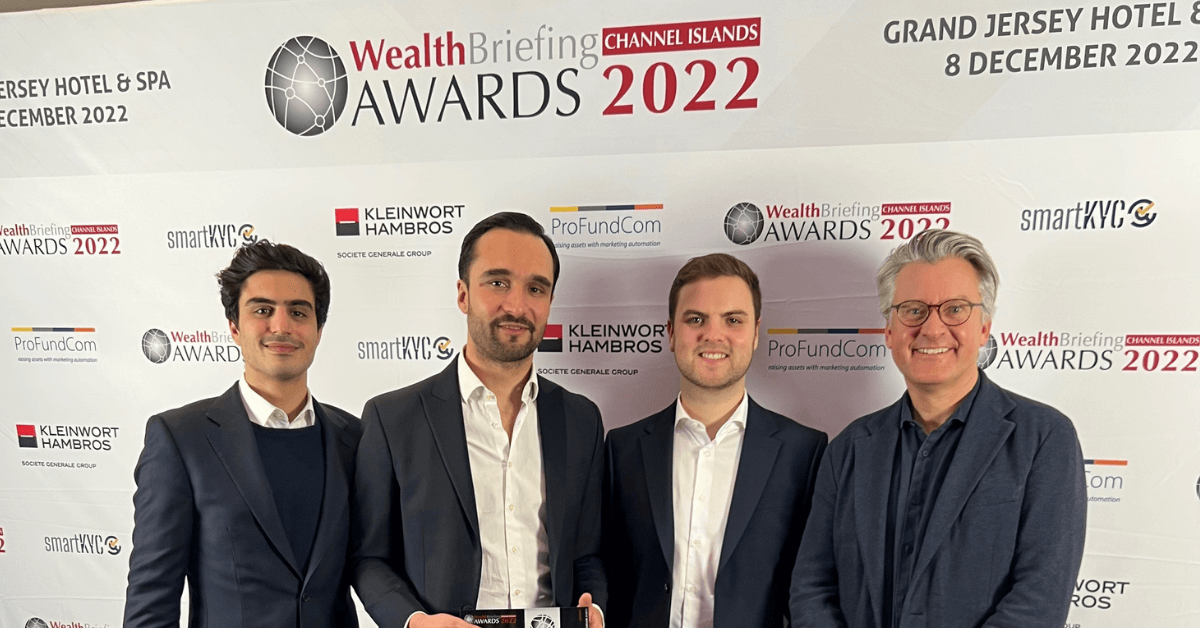

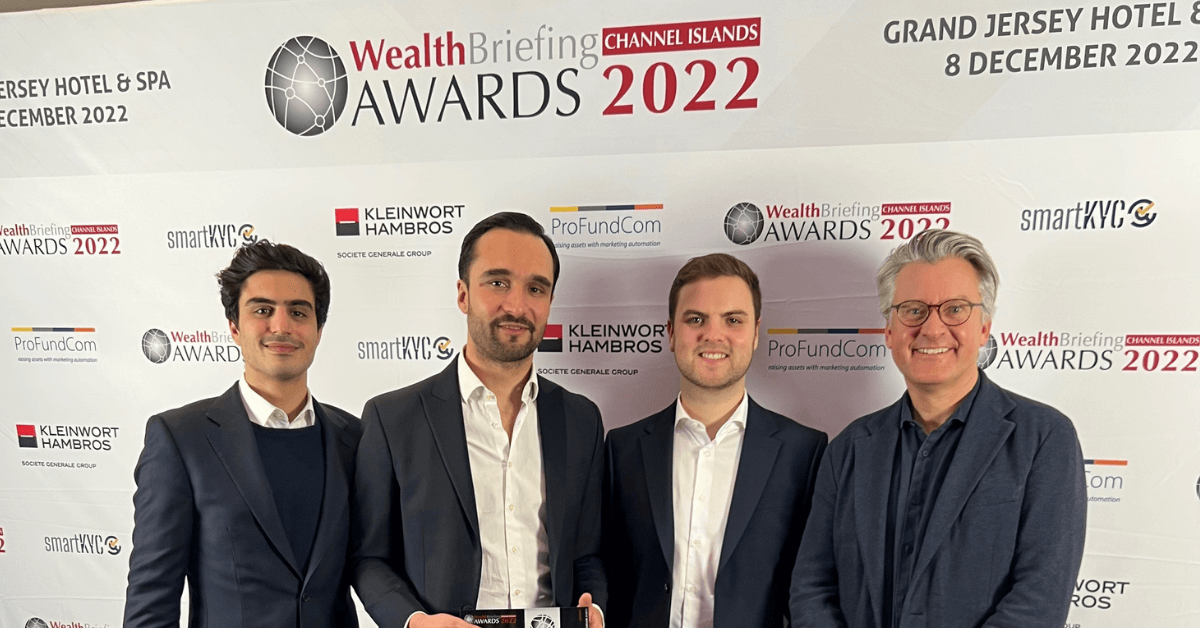

Leading private wealth management industry participant Landytech has joined the ranks of an elite global group who have been handed the honour of winning a WealthBriefing Award.

Landytech was awarded ‘Best Client Reporting’ at the Inaugural WealthBriefing Channel Islands Awards 2022.

Showcasing the best products, industry experts and service providers in the Channel Islands region, the awards have been designed to recognise outstanding organisations grouped by specialism and geography which the prestigious panel of independent judges deemed to have ‘demonstrated innovation and excellence during the last year’.

Each of these categories is highly contested and is subject to a rigorous process before the ultimate winner is selected by the judges. It is this process that makes WealthBriefing awards so prized amongst winners.

The WealthBriefing Channel Islands Awards are part of a global programme run by WealthBriefing and its sister publications WealthBriefingAsia and Family Wealth Report, encompassing all of the world’s major wealth management centres.

Participants around the world recognise that winning awards is particularly important in these challenging times as it gives clients reassurance in the solidity and sustainability of the winner’s business and operating model.

Commenting on the firm’s triumph, Benjamin Mouté, Chief Executive Officer, Landytech said:

Landytech is delighted to be featured as one of the world’s leading family office software providers, in the 2022 Forbes Family Office Software Roundup.

The report pays particular attention to companies supporting the core functions of data aggregation, day-to-day management, and reporting. Many family offices see the Forbes shortlist of providers as an invaluable resource when choosing a technology partner.

The report also shares insights into how family offices are adapting to turbulent markets, the ongoing cybersecurity threat, and the importance of planning for the next generation of wealth owners.

Read the full roundup here.

Landytech is the company behind Sesame, the investment reporting platform that brings clarity to complex wealth, enabling family offices to streamline processes and make more informed investment decisions.

Data-driven digital solutions have become table stakes for trustees. They are no longer a far-off, future project to which firms should aspire. Clients’ digital service expectations are evolving now, and trustees need to deliver.

However, the way many trustees currently manage their data today is hindering their attempts at a full digital transformation. As the data environment gets more complex by the day, manual processes are no longer up to the task.

The ultimate objective is the complete automation of repetitive trust administration processes. But that takes expertise and a sophisticated technology backbone that is inextricably linked to data management. It leaves trustees with a choice. Undertake the investment and implement the capabilities in-house, or partner with a specialist third party. Either way, it’s a decision that can’t be delayed.

As trustees start their journey to a data-driven future, there are multiple complex data challenges they must overcome. Here’s how firms can go about solving them.

After almost two years of record returns, market volatility and the looming threat of recession has left family offices anxious. Amid continued inflationary pressure and lower expected returns, some are looking to increasingly exotic portfolio diversifiers for outsized returns, whilst others seek to reduce risk and play it safe. All, however, are seeking opportunities to streamline their operations, against a backdrop of rising costs.

Read more

Asset managers continue to grapple with a number of challenges spanning cost squeezes, fee pressures and patchy returns. They are under pressure to find significant operational efficiencies, and fast. The question of how far managers should go in outsourcing and automating various functions to find these efficiencies has become a hot topic of discussion.

Read more

In recent years, family office portfolios have benefited from robust economic growth, relative geopolitical stability, persistently low inflation and interest rates, and relatively low volatility. But family offices, just like other financial market participants, now face greater uncertainty and elevated levels of market volatility.

Read more

As a family office, deepening relationships and growing the business is your lifeblood. In today’s fast-moving environment, a robust technological backbone is critical to success. Uncertainty in the financial markets is increasing attention on portfolio performance and placing greater emphasis on the service expectations of families. They want a rich flow of timely information at their fingertips and a consolidated picture of their net worth. As a result, many family offices are realising that their software requirements have increased, and that legacy technology is no longer capable of sustaining future portfolio management needs.

Read more

Technology is vital for trustees looking to thrive in the modern world. Automating data management processes and autonomous investment monitoring doesn’t just help to save resources, it also gives trustees the opportunity to focus on delivering a better overall client experience, to enable business growth.

Read more

SFDR is one of the largest pieces of ESG-related legislation rolled out anywhere in the world, and their compliance requirements are a daunting prospect for fund managers and wider financial market participants.

Read more

Once confined to a world of spreadsheets and static presentations, family office reporting is beginning to take on a radically different form as automated data consolidation and near-real-time portfolio monitoring become the norm.

Read more

Despite recent market turbulence, there has been no let-up in the deluge of new regulation on the way. It means asset managers are having to invest even more time, effort and money into meeting new requirements, posing a significant challenge for small and emerging managers, where funds, resources and staff are often in short supply.

Read more

There has been an explosion in the popularity of environmental, social, and governance funds in recent years. In light of this growth, fund managers have been increasingly keen to step up their commitment to ESG and its measurement.

The rewards for those that get it right are high. An authentic ESG strategy that is evident through a firm’s products, their investment process and data-driven reporting is easy for existing investors to understand and attractive to prospects that value ESG highly.

Asset managers must demonstrate that their fund disclosures and reporting approach meets parameters which are strictly linked to ESG reporting criteria. But reporting is not an easy landscape to navigate when it comes to ESG.

The EU has started to implement the Sustainable Finance Disclosure Regulation (SFDR), which sets out rules for classifying and reporting on sustainability and ESG factors in investments. But whilst regulators and industry bodies across the globe play catch up, there has been a distinct lack of guidance for asset managers compared to other more established investment reports.

Despite this ambiguity, there are three principles ESG reports should adhere to: authenticity, substance and defendable data. Asset managers need to be transparent on the methodological approach followed in their investment strategy, implementation of governance and the reporting in place.

Today, most asset managers have several options to demonstrate the transparency and accountability of their ESG funds. But how these are implemented for reporting depends on the ESG strategy in place, and the jurisdiction in which the asset manager is operating.

As family portfolios become more complex and the data burden increases, family office staff are increasingly bogged down in spreadsheets and legacy systems that struggle to keep up. And as families become exposed to more and more sophisticated digital experiences across all areas of life, expectations of the service they receive from their family office is evolving rapidly.

Find out how family offices across the globe are using Sesame to transform their data and reporting workflows, freeing up time for them to deepen relationships with families and grow their business.

To date, there has been reluctance from asset managers when it comes to fully digitalising their reporting processes. But as investor service expectations evolve in their pursuit of clearer insights, more risk metrics and visually compelling reports, asset managers need the on-demand flexibility to keep up.

Coupled together with the increasing complexity of regulatory reporting, firms are turning to software platforms that can provide them with a single ecosystem for their data and the powerful analytics and reporting engine they need to futureproof their business and set themselves up to win institutional mandates.

The concept of the trust was created in England, but many Commonwealth jurisdictions have since adopted the concept into domestic law. A trust is a legally binding arrangement where someone transfers property to another person or legal entity for the benefit of a third party.

Read more

Interest in ESG has increased exponentially in recent years and there has been no sign of slowing in 2022, so far. But it is not just inflows to ESG funds that has been increasing. As policymakers turn their attention to environmental, social, and governance concerns, there has been increased pressure for asset managers to provide more data and consistent reporting around ESG investments.

Although a tightening of regulation is presenting asset managers with new data and reporting challenges that must be addressed, it is also creating new market opportunities. In particular, the opportunity to develop new fund vehicles that legitimately address environmental, social and governance concerns, and meet the demands of today’s ESG-conscious investors.

So, what are the trends shaping the ESG agenda for asset managers?

Read more

A considerable proportion of global wealth is owned by individuals who are close to or older than 60 years old – it’s been estimated that more than US$30 trillion will be transferred from one generation to the next over the next few decades.

Most family office advisors have spent the majority of their careers providing investment and financial advice to affluent baby boomers. But an aging client base poses a considerable risk to the long-term viability of multi-family offices.

Intergenerational wealth transfer is one of the main causes of client attrition, as clients pass, and beneficiaries take their assets elsewhere. If multi-family offices don’t develop relationships with their clients’ heirs, the chances of retaining assets are low.

So, how can technology help multi-family offices to deepen relationships with future generations now to ensure their business is futureproofed for decades to come?

When it comes to reporting, many firms still rely on outdated technology and legacy systems. Combining data from multiple sources and offline spreadsheets is an inefficient process that takes far too long, is highly prone to manual errors, and limits reporting flexibility.

It is no revelation that clients are increasingly savvy investors, and at a time of increasing market volatility and industry competition, expectations are soaring. Clients want on-demand, granular reporting, and legacy processes are straining under the pressure.

Read more

The EU has started to implement the Sustainable Finance Disclosure Regulation (SFDR), which sets out rules for classifying and reporting on sustainability and ESG factors in investments.

Read more

Many members of the investment management community, hesitant to act as early adopters, have resisted pressure to fully digitalise and automate reporting – so far. Firms often want to see that new technology has been implemented successfully at competitors before making the leap. However, across the investment management spectrum, the need for a radically different approach to investment reporting has never been greater.

Increased competition and industry consolidation makes delivering – and proving – higher returns more important than ever, requiring advanced analytics and reporting. It’s also putting the squeeze on fees, pressuring firms to reduce the total cost of ownership for their IT tech stack and legacy systems. More efficient solutions need to be found if operational alpha is to be achieved.

In this shifting landscape, implementing a data-driven, agile approach to investment reporting can help asset and wealth managers get back ahead of the game.

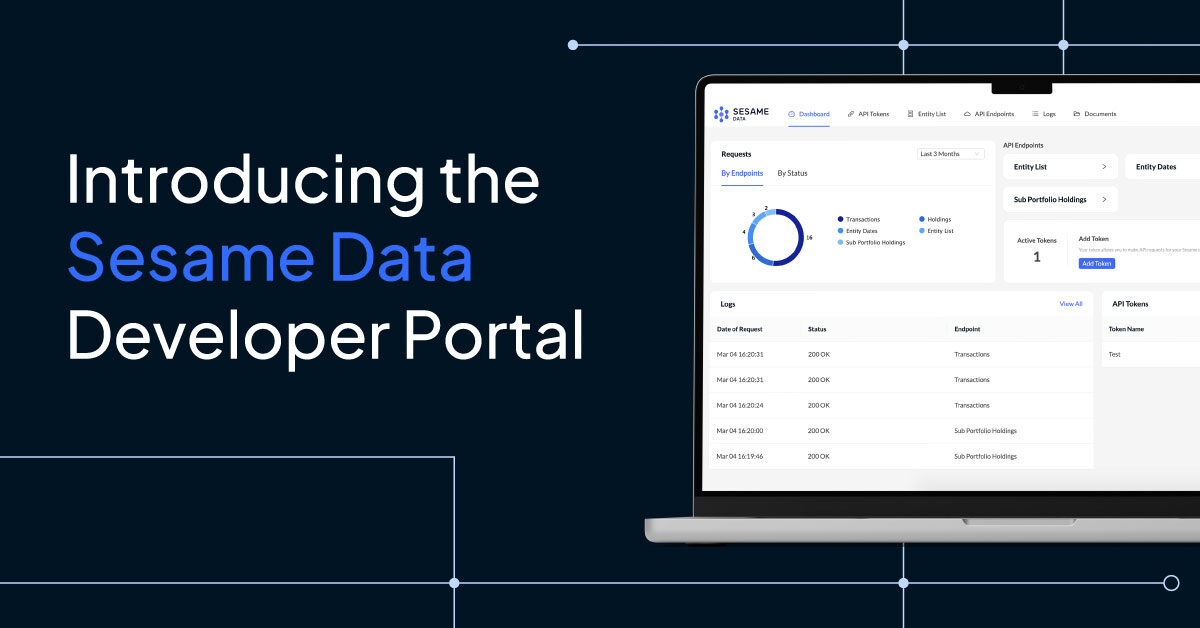

With the unrelenting effort that sourcing and standardising custodial data from multiple sources requires, a rest might seem like the last thing on your mind when conducting reporting. But it should be. No, we don’t mean lying down and taking a nap! We mean using a REST API capable of delivering all your custodial data into your internal systems in one standardised format, whenever you need it.

Read more/Blog%20and%20content%20images/Performance-and-risk-analytics-Blog.jpg)

In recent years, the complexity of performance measurement and risk calculations and the volume of data required to fuel them has increased exponentially, presenting asset managers with a significant challenge.

Read more

The investment management industry is one of the most data-intensive in the world. Yet with manual processes still commonplace, accessing and leveraging this vast data for efficient and robust front, middle, and back-office workflows is still not the norm. But things are changing. As the industry accelerates its digital transformation, the use of APIs to streamline data flows is becoming table stakes.

Read more/Blog%20images/Cloud-based-investment-management-software%20blog.jpg)

Asset and wealth manager attitudes towards cloud-based investment management software systems have undergone a radical transformation in recent years.

Read more

Implementing a fit-for-purpose risk management and reporting function is expensive. But for asset managers, the cost of sub-standard risk capabilities is even higher.

Read more

Ultra-high-net-worth (UHNW) families typically have a plethora of accounts, portfolios, trusts and managers. Yet not having a complete picture of their holdings can cause them frustration. In light of this, they are increasingly turning to their family offices to deliver the consolidated reporting that will provide the visibility they desire.

Read more

Today’s family offices want to deliver a strong risk-adjusted investment performance that is aligned with family members’ priorities. To prove the value they’re adding, they also want to be able to communicate that performance, and the value of holdings, to families.

Read more

London Office

52a Cromwell Road,

London, SW7 5BE,

United Kingdom

Paris Office

140 rue Victor Hugo,

92300 Levallois-Perret,

France

Pune Office

B -111, Pride Silicon Plaza, S. No. 106 A, Senapati Bapat Road, Pune - 411 016,

India